October 19, 2023

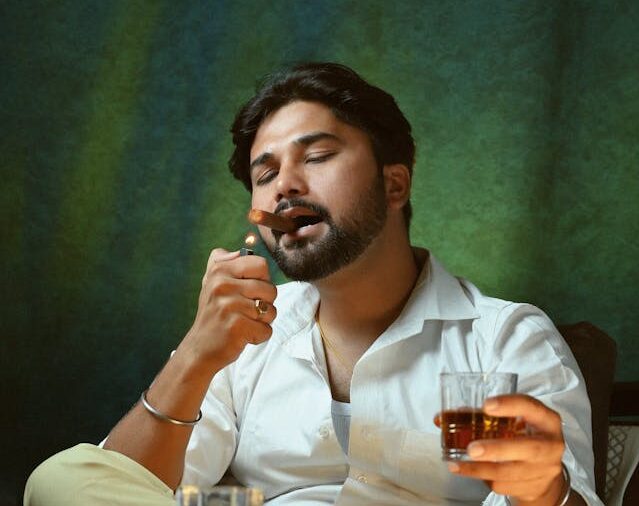

Brooklyn-born and -raised Ejiro Ajueyitsi says he has at all times been pushed to assist the Black neighborhood. He’d initially deliberate for a medical profession, however the 2008 recession led him in a totally totally different however nonetheless worthwhile path.

At the moment, Ajueyitsi owns the one Black brokerage for personal lending within the U.S., the Brooklyn Funding Group. In contrast to a standard financial institution, which requires tax returns, revenue verification, and W-2s when making use of for a mortgage mortgage that takes between 45 and 60 days for approval, the Brooklyn Funding Group approves loans inside days for fix-and-flip tasks, new building tasks, multi-family bridge loans, and rental properties.

“So if someone wants a 30-year mortgage and doesn’t wish to present their taxes or have it present on their credit score report and mess up their debt-to-income ratio, we solely take the revenue of the leases and if somebody needs to construct a one-family home or a 100-floor skyscraper we offer capital for that,” Ajueyitsi advised BLACK ENTERPRISE.

Moreover, the Brooklyn Funding Group has given out loans on dilapidated properties, one thing Ajueyitsi says banks do in a restricted capability.

Initially a pupil on the medical college monitor within the early 2000s, Ajueyitsi took a yr off and acquired into graphic designing, making flyers for events in Brooklyn to make ends meet. Finally he started constructing web sites for artists in addition to doing postproduction and music movies.

Nevertheless, the 2008 housing disaster put an finish to his enterprise, and Ajueyitsi started consulting for web sites and residential care businesses earlier than venturing into actual property by serving to enterprise house owners discover new properties.

A decade later, he tried to get a mortgage from a number of banks for distressed properties he was excited about however was denied. Nevertheless, considered one of his shoppers, a Black girl who owned a pharmacy, advised him concerning the world of personal lending.

“She put me in contact with a mortgage dealer, and proper there on the spot he acquired me preapproved for a home that I wished,” Ajueyitsi stated. “I had about $300,000 and the home was about $500,000.”

After doing a number of offers on his personal, he realized the individuals who had been making these offers weren’t Black, so he started brokering offers himself for individuals who mounted and flipped homes.

Ajueyitsi finally met with a monetary group and was shocked to find they had been already acquainted with his earlier work. This fateful assembly led to the group giving him entry to $20 million to lend for actual property tasks.

From this, Ajueyitsi created the Brooklyn Funding Group, which in 2022 gave out nearly $50 million to folks to fund their actual property tasks. Ajueyitsi notes that 90% of the individuals who come to the Brooklyn Funding Group are folks of shade, and so they had been in a position to keep away from being affected by the downturn within the housing market final yr.

“We’ve had individuals who stroll into our workplace or discover out about me and say, ‘I’m coming to you as a result of I do know you’re going to take heed to me as an alternative of simply taking a look at paperwork and saying you don’t qualify,’” Ajueyitsi advised BE. “And it’s not that they don’t qualify, they simply don’t know. I’m prepared to take heed to them and say ‘I do know precisely what you imply,’ after which I discover out they don’t seem to be rookies, they’ve extra expertise.”

Ajueyitsi needs to see extra Black personal lenders who can shut the racial wealth hole. His future plans embody instructing free programs on actual property and lending, the place he’ll present capital for brand spanking new school graduates to turn into lenders. Moreover, Ajueyitsi needs to start out his hedge fund to lift between $200 million and $300 million to be a capital supplier for smaller funds and to help Black and brown builders.

“I would like to have the ability to try this for others — that’s my purpose inside the subsequent 18 months,” stated Ajueyitsi. “I really like the flexibility in my journey; I really feel prefer it made me a well-rounded particular person to talk to many various folks. I really feel like I can do something now.”

RELATED CONTENT: Black Monetary Marketing consultant Seeks To Empower African People To Reclaim Misplaced Land By Actual Property Crowdfunding