By JPMorgan Chase & Co.

Fascinated about beginning a enterprise? Listed here are 5 issues to think about

Extra persons are selecting to turn out to be entrepreneurs and chart a path of their very own within the pandemic. In truth, a million extra new enterprise functions have been filed in 2021 than in 2020 – the best whole on record- in accordance with the united statesCensus Bureau.

In case you are able to dive into small enterprise possession, having a plan, understanding your credit score well being, and constructing a robust basis can set you up for fulfillment — and assist you to maintain and develop what you’re working to construct as we speak.

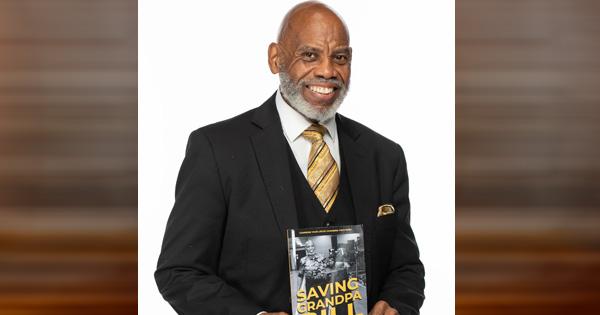

“The early days of constructing a enterprise are thrilling and likewise include many questions. I take pleasure in serving to individuals work out the roadmap and take among the guesswork out of the primary few steps,” stated Chase Senior Enterprise Marketing consultant Hans Petit-Homme.

That can assist you begin, listed here are some ideas for these preliminary steps:

Put it on paper. Each new enterprise ought to begin with a marketing strategy. Even when your begin with the fundamentals, this doc is a blueprint for methods to construct and keep your organization, which is useful to have available as soon as you start to get into the nitty-gritty of getting your operation off the bottom. This 5-steps guidelines may help you are taking necessary actions earlier than you open.

Construct and defend your credit score. Figuring out your credit score rating and the way it works is a constructing block on your total monetary objectives.

“As you begin your online business, it’s necessary to understand your private credit score rating would be the key to assist get hold of preliminary capital, reminiscent of a small enterprise bank card. Holding it robust may help you keep your private AND your online business’ monetary well being,” stated Petit-Homme. “As your online business grows, the monetary well being of your online business is what is going to help you entry different capital and funding, but each your private and enterprise credit score data might be thought-about as a part of the combination when collectors consider your wants.”

One tip: To construct credit score in your online business’ identify, arrange a small enterprise bank card account, pay distributors and suppliers on time, and be conscious of cashflow and liquidity, amongst different issues.

Separate private and enterprise accounts. Many enterprise homeowners begin their corporations with their very own cash, however it is rather necessary to apply the behavior of preserving private and enterprise funds separate. Beginning a small enterprise checking account or opening a enterprise bank card are you able to assist you to preserve monitor of spending and also will assist set up the credit score profile for your online business and simplify your accounting and assist you to when it’s time to file taxes.

Take into consideration bills. Begin-up prices can fluctuate and it’s straightforward to get misplaced within the numbers. Getting a transparent image of how a lot startup cash you will want is crucial to assist keep away from cash-flow issues till your online business begins turning a revenue. Chances are you’ll want to rent workers, buy tools or get an workplace or warehouse house to run your organization. There are lots of methods you possibly can finance your start-up or small enterprise, together with a enterprise mortgage, bank card, line of credit score, tools financing, and small enterprise grants. Figuring out the perfect financing choice relies on your credit score rating, how rapidly you want the cash, and the long-term results it could have on your online business. Communicate with a banker first. They’re there to assist information you.

Ask for assist. When you’re able to get began or develop your online business, take into account having conversations together with your native SBA small enterprise improvement middle (SBDC) which delivers free instruments, counseling and coaching to entrepreneurs. Search out licensed specialists in banking, authorized and tax who may help construct your organization’s infrastructure as you launch. Chase provides free workshops -virtual and in-person.

Bonus tip: The U.S. Small Enterprise Administration (SBA) provides data on the method of registering your online business identify with state and native governments. There are legal responsibility protections, contract alternatives, as properly aslegal and tax advantages you possibly can miss out on by not registering your online business. For instance, as your online business expands, you possibly can apply to turn out to be a provider to bigger companies.

In case you are prepared to start out a cash discuss, schedule a gathering with a Enterprise Banker or Chase Senior Enterprise Marketing consultant. Throughout your preliminary dialog, talk about your marketing strategy, ask for recommendation on methods to handle bills and entry capital, and don’t neglect to ask about out there assets and help.

For extra ideas and perception on methods to benefit from each enterprise and monetary alternative, go to a Chase department close to you.

Sponsored Content material by JPMorgan Chase & Co.