Because the Trump administration begins referring defaulted scholar mortgage accounts for collections on Could 5, advocates for scholar mortgage debt aid and cancellation say President Donald Trump’s abrupt departure from Biden-era insurance policies will disproportionately harm Black debtors and widen the racial wealth hole.

After greater than 5 years of scholar mortgage cost pauses, the Trump administration has escalated the federal authorities’s makes an attempt to gather funds–all of the whereas Republicans in Congress introduce laws to remove reasonably priced scholar mortgage cost packages.

Training Secretary Linda McMahon additionally made clear that mass scholar mortgage debt cancellations issued by President Joe Biden will now not proceed beneath President Trump.

“The chief department doesn’t have the constitutional authority to wipe debt away, nor do the mortgage balances merely disappear. Tons of of billions have already been transferred to taxpayers,” McMahon stated in an announcement on April 21. “Going ahead, the Division of Training, along side the Division of Treasury, will shepherd the scholar mortgage program responsibly and in accordance with the regulation, which suggests serving to debtors return to reimbursement—each for the sake of their very own monetary well being and our nation’s financial outlook.”

Hundreds of thousands of debtors in default now face the federal authorities garnishing funds via tax refunds, salaries (as much as 15%), and even social security internet advantages like Social Safety funds, studies NBC Information. The federal government stated the Workplace of Federal Scholar Support would ship notices about wage garnishment later this summer time.

However advocates and Democrats warn of a recipe for catastrophe because the $1.6 trillion scholar mortgage debt disaster collides with the continued rising prices in housing and primary items and providers, and issues of an financial downturn amid President Trump’s tariff insurance policies and plans to increase tax cuts for rich People.

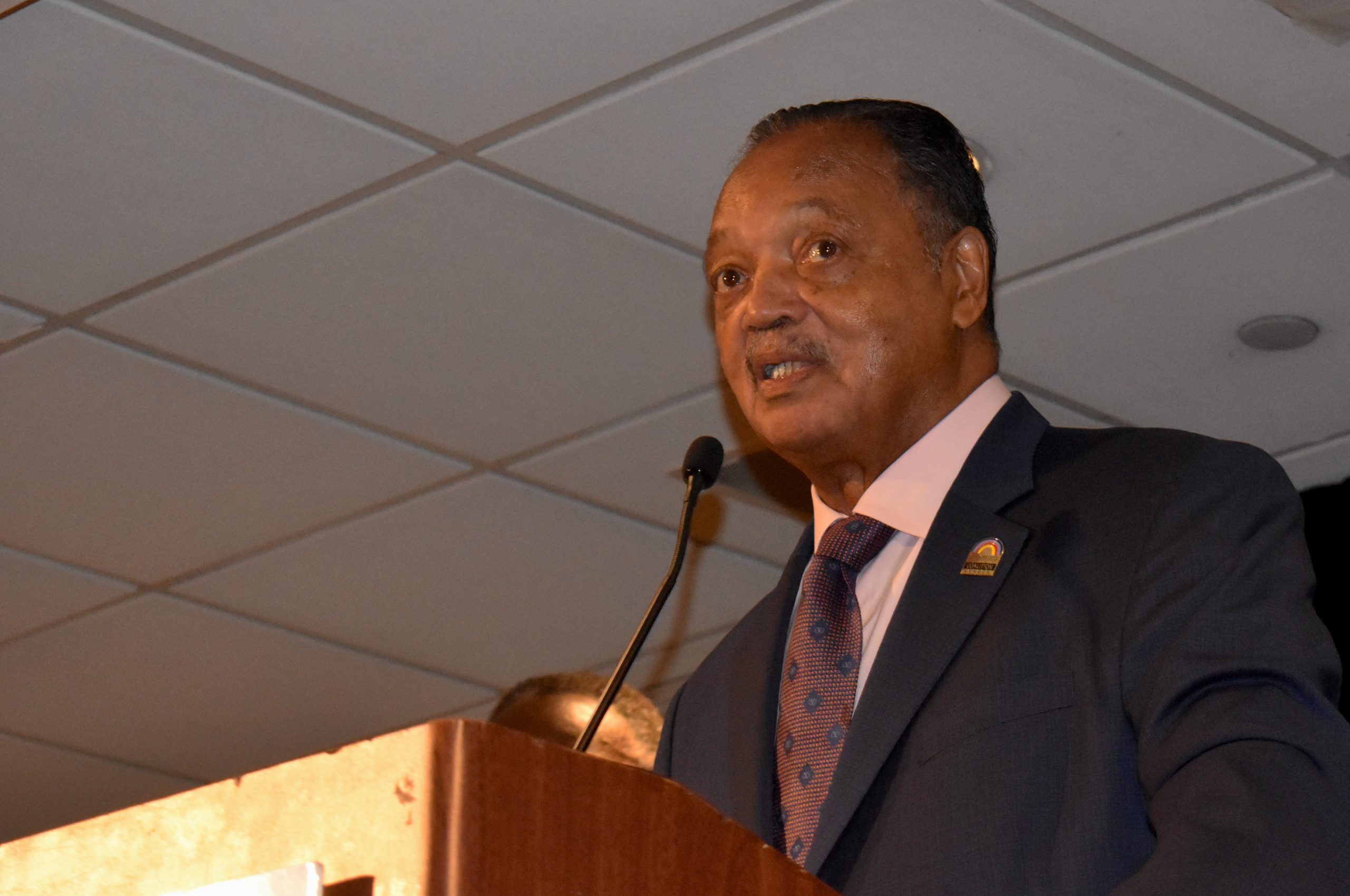

“As folks start to really feel the financial pressure, whether or not it’s forcing people into default due to scholar mortgage funds or eradicating shopper safety, permitting predatory lenders and others to prey on communities, each Black and white, or the rise of price of issues– we’re headed in direction of recession if this continues,” NAACP President Derrick Johnson informed theGrio.

“It’s the American folks, the employees throughout this nation, who hold this economic system going, and so they need to get pleasure from financial progress and never being preyed upon by predatory actions, together with these predatory actions popping out of the White Home.”

Democratic political strategist Ameshia Cross stated that because the Trump administration strikes to gather on scholar loans, Black and low-income debtors, significantly Black girls, will undergo most, as they’ve the “highest scholar debt burden in your entire nation.”

“On prime of that, they needed to borrow extra on the entrance finish due to an absence of familial wealth, and on the again finish, they’re now going to be pressured to basically be in a debtor’s jail,” Cross informed theGrio. “Going to collections [and] having wage garnishments…implies that they gained’t be capable to pay for little one care. Meaning they gained’t be capable to pay for housing. Meaning they’ll be capable to pay for utilities.”

She added, “So there’s a downstream impact right here that pushes somebody into the streets, and this isn’t hyperbole.”

Cross identified that there’s already an affordability subject, as present scholar mortgage plans are nonetheless too expensive for many debtors, who must resolve between paying scholar loans and “holding the roof over their heads.”

“You’re creating a large destitute inhabitants who was solely going to varsity to attempt to do what we have been bought for a really very long time, particularly millennials– that you’d have entry to the center class, that you’d have entry to the American dream, no matter your loved ones background or your poverty degree or your zip code,” Cross defined. “What Donald Trump is doing is showcasing that that’s not true, and he’s forcing these folks to undergo.”

The Trump administration’s newest transfer on scholar mortgage funds comes as Republicans on Capitol Hill have launched a plan to overtake your entire system. Based on NPR, the plan would remove present scholar reimbursement packages like Revenue-Contingent Compensation (ICR) and Pay As You Earn (PAYE) plans, and change them with a “Compensation Help Plan.” Republicans additionally suggest ending the Grad PLUS mortgage program, limiting mum or dad PLUS loans, and forcing faculties and universities to reimburse the federal authorities for debt when their college students fail to repay their loans.

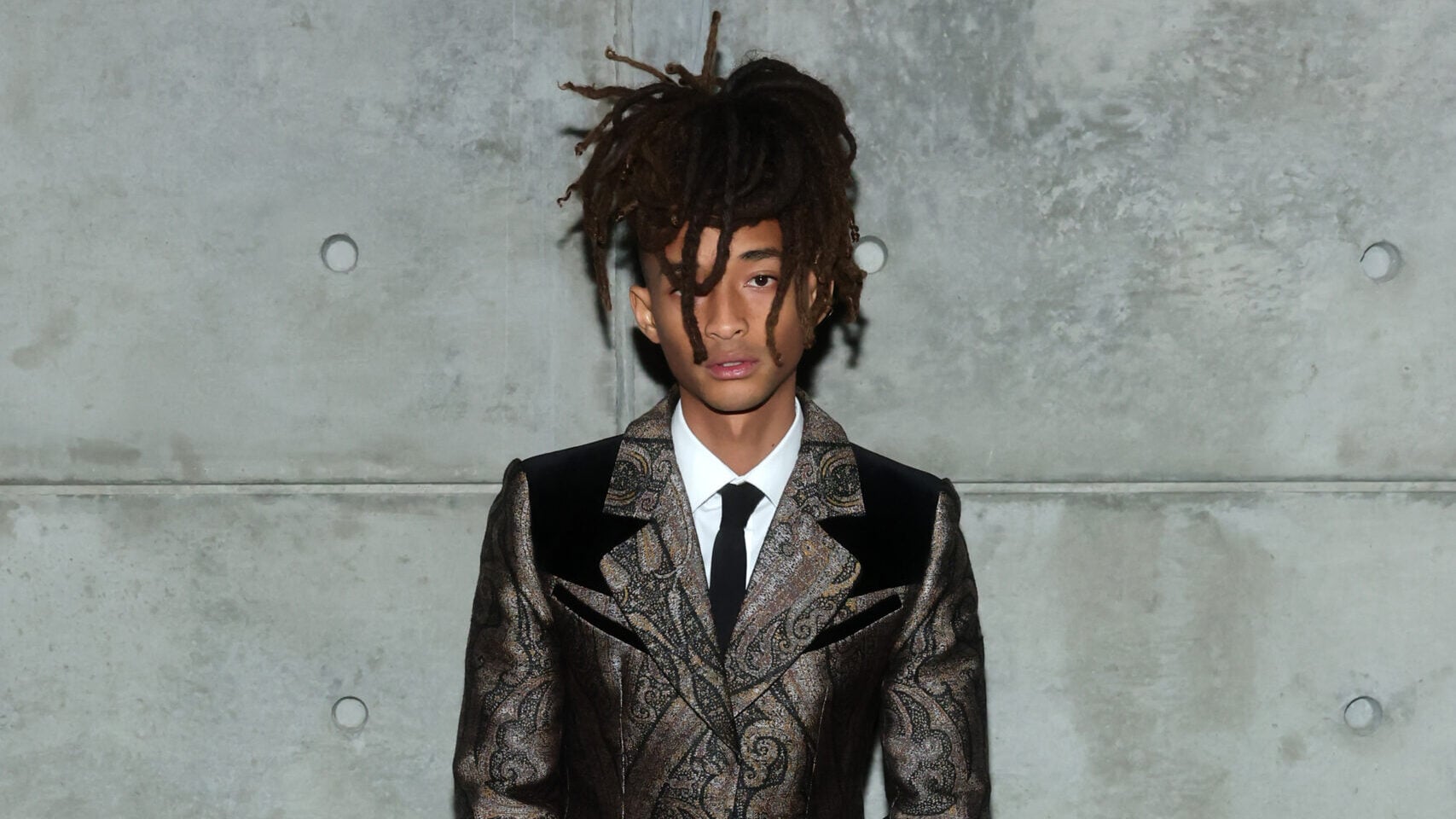

Democratic U.S. Rep. Summer time Lee of Pennsylvania slammed the Republican invoice throughout a Home Training Committee listening to final week.

“Not one of the provisions on this invoice have any incentives for faculties to decrease the price of admissions. What we’re doing as a substitute is incentivizing faculties to take fewer low-income college students,” stated Lee, who famous that, as a Black millennial first-generation faculty graduate, folks like her wouldn’t be afforded the flexibility to attend faculty beneath the newly proposed plan.

The 37-year-old congresswoman known as on the U.S. authorities to speculate extra in public training, which the nation lags behind in in comparison with different developed nations.

“We can’t merely say that we are going to take away the alternatives for college students to entry loans, not change it with anything, not change it with decrease faculty training, not change them with decrease rates of interest, not make the system higher and nonetheless say that you’ll in some way determine it out,” stated Lee.

“We all know the result right here. Black college students, brown college students, poor college students is not going to be left to determine it out. As a substitute, elite college students, college students who come from the 1%, will proceed to have the ability to entry training.”

Lee added, “They’ll proceed to have entry to profession fields…[and[ the achievement gap, the racial gap will just continue to increase because these are not being addressed.”