With spring in full bloom – now is an ideal time to start out a contemporary a basis for a wholesome monetary future. Good monetary well being is the inspiration on which sturdy and resilient households, communities and economies are constructed, however the actuality is, many wrestle to handle their monetary every day lives.

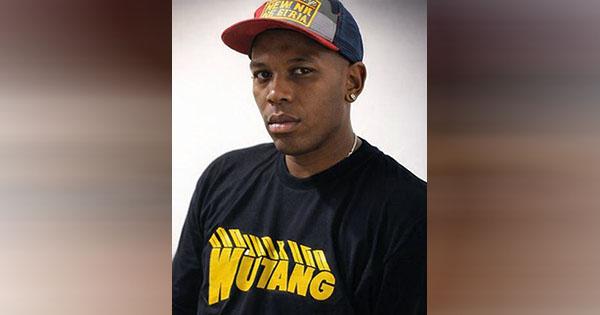

In recognition of Monetary Literacy Month, Christopher Beene, neighborhood supervisor with JPMorgan Chase in Inglewood, provided prime monetary ideas to assist obtain monetary freedom and construct generational wealth.

Associated Hyperlinks:

https://lasentinel.web/celebrating-black-history-month-qa-with-jpmorgan-chases-christopher-beene.html

https://lasentinel.web/jpmorgan-chase-commits-5-million-to-support-black-and-latina-street-vendors-in-los-angeles.html

Small steps result in greater alternatives:It doesn’t matter what amount of cash you might have, taking small steps in the direction of constructing a strong monetary basis is vital. Whether or not it’s saving just a little extra every month, beginning to save for the primary time or monitoring your credit score rating, these steps might help you put together for the surprising whereas setting you up for long-term success.

Set up good credit score: The primary components of securing a superb credit score rating embrace paying your payments on time, the size of time you’ve had a credit score historical past, and the quantity and sort of accounts you might have. Potential lenders will use this info to find out your credit score threat. Managing your funds properly will allow you to set up sturdy credit score, a observe that can repay if you need to make bigger purchases like a automobile or a house.

Embrace digital instruments:Apps, on-line purpose sheets and price range builders are an effective way to handle your funds. Look into what digital instruments your monetary associate presents. Whether or not it’s credit score and establish monitoring, or organising repeating automated transfers out of your checking account to your financial savings account, these instruments will assist hold you on monitor together with your funds and financial savings targets.

Embrace the entire household within the course of: It’s by no means too early to get children began on their monetary journey. Ask your financial institution about opening up a joint checking account geared in the direction of youngsters to assist them set up good monetary habits. A joint account can provide options designed to assist children be taught the significance of saving and assembly their monetary targets, whether or not it’s monitoring their spending, creating recurring funds and setting spending limits, or being rewarded when finishing chores and incomes an allowance to deposit. As soon as your youngster understands the significance of saving the cash they earn, they’ll start to construct financial savings habits that can final a lifetime.

Ask for assist: Whether or not it’s assembly with a banker or speaking to buddies or household, conversations and recommendation will be essential to bettering monetary well being, from constructing a price range to extra complicated issues like saving for retirement.

Maintain the dialog going:Speak together with your associate or different relations repeatedly about your monetary targets and the way you intend to attain them, and verify in together with your youngsters to debate their monetary exercise – whether or not it’s what or the place they’re spending, how a lot they’re incomes, or their financial savings purpose. These discussions all present alternatives to maintain cash as a part of your loved ones conversations.

Establishing strong monetary habits generally is a lifetime course of, nevertheless it’s simpler should you be taught the basics as early as doable. It’s by no means too early, or too late, to start your journey, and this month is a good time to get began or recommit to your monetary well being. For extra monetary well being ideas, go to chase.com/financialgoals.