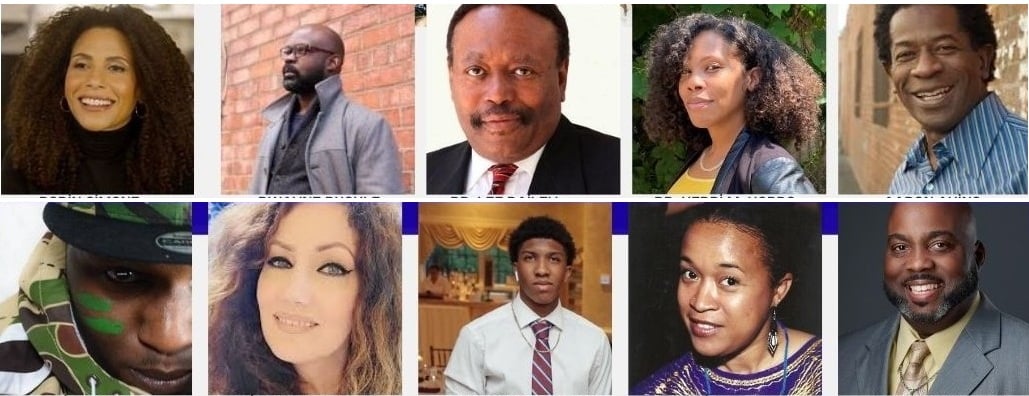

Chawn Payton is a monetary advisor at Northwestern Mutual in Atlanta. After graduating from FAMU, Payton started his profession in engineering and landed a job at Accenture, the place he labored for 9 years. Early on, a dialog with a supervisor modified all the pieces; he realized that investing in inventory again in highschool had already put his peer forward financially. That realization opened his eyes to the wealth hole and sparked a ardour to study extra about cash. He began surrounding himself with financially savvy buddies, sharing data with family members, and ultimately bought licensed after a former engineer-turned-advisor inspired him. Bored with company life, Payton made his foray into wealth administration to assist others begin their path to monetary freedom. He was our visitor on A Seat At The Desk and dropped some money-related gems.

What’s your present function at Northwestern Mutual, and what providers do you present to your purchasers?

Man, titles are cool, however truthfully, I’m various things to completely different folks; some name me a monetary therapist, counselor, or perhaps a guru. I work intently with households and enterprise house owners to cut back monetary anxiousness, assist them acquire stability, and finally construct long-term safety. Many of us don’t notice how a lot stress cash causes till they sit down and talk about it. So we stroll by means of the place they’re and the place they need to be—personally, professionally, and financially, and I create a monetary roadmap to assist them get there. It’s not nearly numbers; it’s about serving to them really feel assured and guarded of their choices.

How did your time at FAMU affect your strategy as a monetary advisor?

I goal to make monetary conversations cool once more in our Black group. At FAMU, I noticed firsthand how cash wasn’t one thing we mentioned brazenly—there was typically disgrace or silence round it, particularly if you happen to have been struggling. That have taught me we will’t repair what we received’t face. So now, whether or not I’m in a room with friends or purchasers, I convey up cash in an actual, relatable, and judgment-free means. FAMU gave me that lens—understanding the gaps we have to fill and the way highly effective it may be once we begin addressing funds with the identical vitality we give psychological well being, actual property, and alternative constructing.

How can Black households construct generational wealth?

Initially, be educated; both you or discover someone that you just belief that is educated. And I say that as a result of, identical to you’d see a physician for one thing larger than a headache, there are monetary issues you may deal with your self and others you want knowledgeable for. So that you gotta have some recreation plan on what you need to do together with your cash, after which simply put methods in place and take into consideration what legacy and generational wealth means to you. Do we’ve got any trusts in place? Any last-will-and-testaments? Life insurance coverage? Funding accounts? Actual property? A enterprise? And lastly, I believe there needs to be some sacrifice concerned; you won’t profit your technology, however you’re setting it up for the following technology.

What’s some recommendation for younger folks making an attempt to get into wealth administration?

You gotta be intentional. You gotta search it out. So if you happen to’re in center or highschool, ask your counselor, “Are there any finance courses? Any finance books? What careers can I look into?” LinkedIn is a strong device—if I see an 18-year-old attain out and say, “Hey, Mr. Payton, I see you in finance and would like to seize a espresso,” it jogs my memory I must pay that ahead. Individuals need to provide help to obtain your targets, particularly if you happen to’re younger and bold. Finance is a type of fields the place perhaps one or two % of advisors are Black, so there’s loads of alternative and development. I’d say, search it out.