by BLACK ENTERPRISE Editors

November 20, 2025

CheapInsurance.com cites examples of states with the best, common, and lowest legal responsibility limits and offers an inventory of every state’s required minimal legal responsibility limits.

On this article, CheapInsurance.com cites examples of states with the best, common, and lowest legal responsibility limits, after which offers an inventory of every state’s required minimal legal responsibility limits. These searching for legitimate protection, significantly within the context of financing or leasing a car, must also notice why merely assembly the minimal could also be dangerous.

What “Minimal Legal responsibility Protection” Means and Why It Exists

Each U.S. state, besides one, requires drivers to hold a minimal stage of auto insurance coverage to function a car legally.

Legal responsibility protection protects different folks and their property when the insured driver is at fault in an accident. Particularly, it consists of two predominant elements:

Bodily Damage (BI) Legal responsibility: That is the quantity the insurer pays for others’ medical bills, misplaced wages, or authorized claims when the insured driver injures somebody.

Property Harm (PD) Legal responsibility: That is the quantity the insurer pays for harm to another person’s car or property when the insured driver is at fault.

These limits are usually expressed as a set of numbers, equivalent to 25/50/25. This format means $25,000 per individual for harm, as much as $50,000 per accident for harm to all individuals, and $25,000 for property harm.

States mandate these minimal protection ranges to make sure that victims of accidents have some supply of compensation and that drivers assume monetary accountability, stopping others from having to soak up the price of the damages.

Instance State Comparisons: Highest, Common and Lowest Minimums

To make clear how extensively these obligatory legal responsibility coverages differ throughout america, CheapInsurance.com examines particular state examples.

Highest Minimums Instance: Maine

In Maine, the minimal bodily harm legal responsibility is $50,000 per individual and $100,000 per accident, with property harm legal responsibility at $25,000. This locations Maine among the many states with the best statutory minimal legal responsibility protection. That is vital as a result of if a driver causes a severe accident in Maine, the insurer covers prices as much as these limits. Nonetheless, the motive force could also be personally answerable for any prices exceeding these limits.

Nationwide Common kind Instance: Georgia

In Georgia, the minimal legal responsibility limits are $25,000 per individual bodily harm, $50,000 per accident bodily harm, and $25,000 property harm. These 25/50/25 ranges are frequent throughout many states. Quite a few drivers assume they’re adequately protected just because they meet the minimal requirement, a perception that may show dangerous in a severe accident.

Lowest Minimums Instance: New Hampshire

New Hampshire stands as an exception to almost all different states as of early 2025. Drivers there are usually not mandated to hold particular legal responsibility insurance coverage; as an alternative, they have to merely show “monetary accountability.” Whereas that is the least strict requirement (permitting proof of belongings or a bond), it usually ends in the state’s minimal monetary accountability limits of $25,000/$50,000/$25,000.

These limits are ceaselessly insufficient safety; a driver at fault in a severe accident could face an insurance coverage declare the place damages (medical payments, property restore) far exceed the minimal protection, placing private belongings in danger to cowl the distinction.

Why You Would possibly Want Protection Past the Minimal

Assembly the authorized minimal protects one legally, however usually fails to offer satisfactory monetary safety or guarantee a easy auto insurance coverage expertise. Insurance coverage consultants ceaselessly advocate customers contemplate increased limits or further protection for a number of frequent monetary and threat administration causes:

When a car is financed or leased

When financing or leasing a car, the lender or lessor normally requires the motive force to take care of not solely legal responsibility protection but additionally full protection, which incorporates collision and complete insurance coverage, to guard their funding. Moreover, if a driver causes an accident and the prices for repairs or negligence exceed their legal responsibility limits, the lender or different events might pursue them for the distinction. Selecting solely minimal limits ceaselessly leaves a driver underinsured.

When different helpful belongings are owned

For people who personal belongings equivalent to a house, financial savings, investments, or different private property, a lawsuit ensuing from a severe automobile accident might simply exceed minimal legal responsibility limits. This publicity creates a major threat to particular person belongings. Choosing the next legal responsibility restrict helps protect and shield these helpful possessions.

When safety from uninsured or underinsured drivers is desired

Many states’ minimal legal responsibility coverages don’t embody, or solely minimally embody, uninsured or underinsured motorist (UM/UIM) protection. This protection is crucial as a result of it protects the insured if one other individual causes a crash and doesn’t carry sufficient insurance coverage to cowl the damages. Including increased limits or elective coverages considerably will increase the margin of economic security.

When restore and substitute prices are excessive

Fashionable autos usually value considerably extra to restore than the property harm legal responsibility minimums established in lots of states. Equally, medical prices proceed to rise. Minimal limits could not adequately cowl a multi-vehicle accident or a extra severe harm, leaving the motive force answerable for substantial out-of-pocket bills.

How you can Interpret and Use These Minimums

All the time examine a state’s required minimal. For probably the most correct and present knowledge, one can seek the advice of state Departments of Insurance coverage or regulatory guides, equivalent to these from the Nationwide Affiliation of Insurance coverage Commissioners (NAIC).

Perceive the three-number format: Protection limits are offered as “per individual/per accident/property harm.”

Minimal protection is authorized, however not at all times protected: Whereas assembly the minimal is legally legitimate, it is probably not the most secure monetary selection.

Interstate driving concerns: Coverage protection should meet the registered state’s necessities; if driving in a state with increased minimums, the insurer might have to regulate accordingly.

Price of elevated limits: When searching for an improve in legal responsibility limits, ask an agent in regards to the further value, because the incremental value is usually modest.

Figuring out satisfactory protection

The authorized minimal legal responsibility protection is the baseline. CheapInsurance.com recommends evaluating belongings, car worth, and threat publicity to find out if protection ought to exceed the minimal.

If a car is financed or leased, or if vital belongings exist (house, financial savings, investments), it’s smart to contemplate protection properly above the state minimal.

When searching for a brand new automobile insurance coverage coverage or evaluating quotes, don’t cease at “meets the minimal.” Discover legal responsibility limits, elective coverages, uninsured or underinsured motorist safety, and whether or not the coverage covers greater than the fundamentals

Word: All the time affirm together with your state’s present regulatory supply or your insurance coverage agent, as limits could change.

Word: All the time affirm together with your state’s present regulatory supply or your insurance coverage agent, as limits could change.

The authorized minimal legal responsibility protection represents solely probably the most fundamental requirement. Each driver ought to completely consider their whole belongings, car worth, and private threat publicity to find out the suitable legal responsibility limits.

For drivers financing or leasing a car, or these with vital belongings equivalent to a house, financial savings, or investments, securing protection properly above the state minimal is a prudent monetary resolution.

When searching for a brand new automobile insurance coverage coverage or evaluating quotes, keep away from merely settling for the “meets the minimal” choice. As a substitute, discover increased legal responsibility limits, helpful elective coverages, and satisfactory uninsured or underinsured motorist safety.

Use this text as a foundational reference for understanding state minimums, however at all times examine with a licensed insurance coverage agent or the state Division of Insurance coverage for probably the most present and particular necessities.

This story was produced by CheapInsurance.com and reviewed and distributed by Stacker.

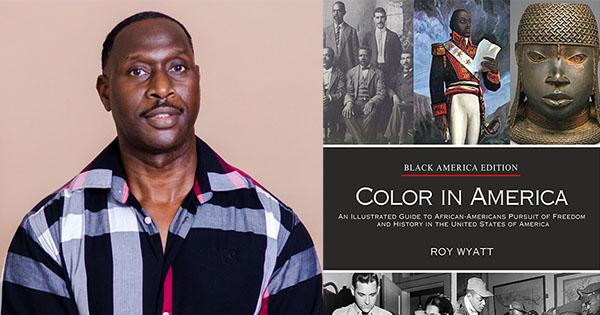

RELATED CONTENT: Inaugural Artist-In-Residence Dr. Yaba Blay and Most Unbelievable Studio Create ‘The BAMBOO,’ Elevating Icon to Cultural Artifact