A bit of over a month after vital layoffs on the Federal Scholar Help workplace within the Division of Training, the Trump Administration has introduced that collections on defaulted federal scholar loans will resume subsequent month.

Starting on Could 5, the Division of Training will restart involuntary collections of federal scholar loans by way of the Treasury Division’s offset program after a five-year pause, since 2020, initially launched by the Trump Administration. Additional, after a 30-day discover, the division may also start garnishing wages for debtors in default.

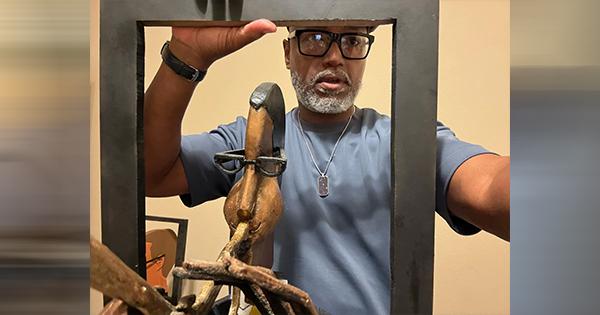

The announcement arrives as greater than 42.7 million people within the nation owe federal scholar loans totaling over $1.6 trillion in debt, and a disproportionate quantity of them occur to be Black. Within the U.S., for these Black folks with bachelor’s levels, 83% of them have federal loans, in line with information by Training Knowledge Initiative. The analysis group has additionally discovered that Black debtors—who’re already subjected to greater charges, on common, throughout the first 4 years of commencement—are inclined to owe greater than they initially borrowed. Additionally they are inclined to owe roughly $3,800 greater than their white counterparts.

The announcement arrives when there has already been a lot whiplash across the messaging relating to scholar loans. There’s numerous confusion and questions on what occurs subsequent, who particularly this impacts, and what, if something, may be finished to keep away from wage garnishment.

Earlier than you rush to panic, take a deep breath. The explainer beneath solutions all of your questions, together with whether or not the Division of Training and Federal Scholar Help are nonetheless a factor.

What does this imply?

Level clean, when you’ve got federal scholar loans which have defaulted—as in you missed too many funds, so your account was despatched to debt collections—these collections will resume, beginning on Could 5; federal scholar loans default for debtors who don’t make funds for 9 months or extra.

Collections for federal scholar loans, together with these in default, have been on pause since 2020 to assist present ongoing reduction in the course of the COVID-19 pandemic.

I assumed the Biden Adminstration canceled scholar loans…

We want! Sadly, regardless of a number of makes an attempt, the Biden Administration was unsuccessful in passing any type of sweeping federal scholar mortgage forgiveness.

How do I do know if this impacts me?

The non permanent pause on federal scholar mortgage funds has been lifted since October 2024. In case you are not sure of your mortgage’s standing, yow will discover out by logging into your StudentAid.gov account utilizing your FSA ID. If it’s been a minute, because it has been for a lot of, you possibly can arrange new login credentials after the required verification.

Since collections are starting once more for the primary time in 5 years, it’s additionally advisable to replace any, and all, contact info so you don’t miss essential communications the division or collections could attempt to provoke.

Will the latest FSA and DOE layoffs affect compensation?

The quick reply: Sure. AP Information reported that the latest layoffs have actually made it “tougher” to have questions answered relating to loans and potential compensation plans. Bearing this in thoughts, count on to must make use of some endurance when reaching out. It could require multiple try.

What’s step one I ought to take if my loans are in default?

Absolutely the first step is to refamiliarize your self together with your scholar mortgage account. Discover and replace any essential logins and replace any contact info. Then arrange a compensation plan and even set up a one-time rehabilitation plan to get the mortgage out of default. Loans are not in default after a sure variety of on-time funds have been made.

How do I keep away from my wages being garnished?

Start making funds once more and/or set up a compensation plan. In response to NPR, debtors who’re in default can count on to listen to from the division starting subsequent week, urging them to both make a cost or arrange a compensation plan.