Jean-Baptiste Ondaye, Minister for the Financial system and Finance within the Republic of Congo, provides an outline of his nation’s monetary scenario, and descriptions the work underway within the CEMAC zone when it comes to monetary inclusion.

What do you consider the extent of digitalisation of banking providers within the Congo and the CEMAC zone?

The CEMAC zone has made vital progress, based on a comparative examine based mostly on variables equivalent to web sites and social networks, entry to on-line financial institution accounts and cell banking purposes.

To what extent will your monetary inclusion technique, which is in step with CEMAC’s regional initiatives, stimulate higher financial integration in Central Africa?

You might be referring to CEMAC’s 2023-2027 regional monetary inclusion technique, which has simply been adopted. It has been designed to take away the constraints to formal monetary inclusion on the demand aspect in addition to on the availability aspect, the authorized and regulatory framework and the monetary sector atmosphere in CEMAC.

The goal is subsequently to advertise monetary inclusion in every member nation and cross-border digital funds inside the Group.

The target of the Nationwide Improvement Plan 2022-26 is to construct a robust, diversified, and resilient economic system, with a view to creating extra wealth and jobs, notably for younger individuals and ladies.

The COBAC has determined to ban using crypto-assets and bitcoin. Isn’t there a danger that this resolution will have an effect on the availability of cash and put a brake on funding?

I don’t suppose so. In Might 2022, the COBAC issued a reminder of sure prohibitions relating firstly to using crypto-assets, and secondly to the prohibition of bitcoin or some other crypto-currency as a way of valuing the belongings, liabilities or off-balance sheet objects of reporting establishments. This resolution was motivated by a priority to make sure monetary stability and defend buyer deposits. Removed from hindering funding and innovation, these provisions assist to keep up a framework of economic transparency and stability, which is without doubt one of the key elements in investor decision-making.

The Congolese banking sector is an oligopoly dominated by overseas banks, whereas the financial institution penetration charge is 15%, beneath the African common. What technique do you envisage to treatment this example?

The Congolese monetary system contains ten business banks, sixteen microfinance establishments, six insurance coverage firms and two pension funds. It additionally contains BDEAC (Banque de développement des États de l’Afrique centrale), inventory trade firms and portfolio administration firms.

What’s your place on the way forward for the CFA franc in Central Africa?

That’s as much as the CEMAC Heads of State to determine!

What’s the financial outlook for the nations of Central Africa? What reforms are wanted to speed up progress and cut back inflation?

Within the case of the Congo, financial progress, estimated at 4% in 2023, ought to rise to 4.4% in 2024. Inflation (4.5% in 2023) is because of greater vitality costs, disruptions to the availability chain, and chronic value shocks as a result of latest rise in import costs.

What stage have you ever reached in your negotiations with the IMF?

You’ll have learn that the IMF Government Board authorized the fourth overview below the Prolonged Credit score Facility (ECF) on 20 December 2023.

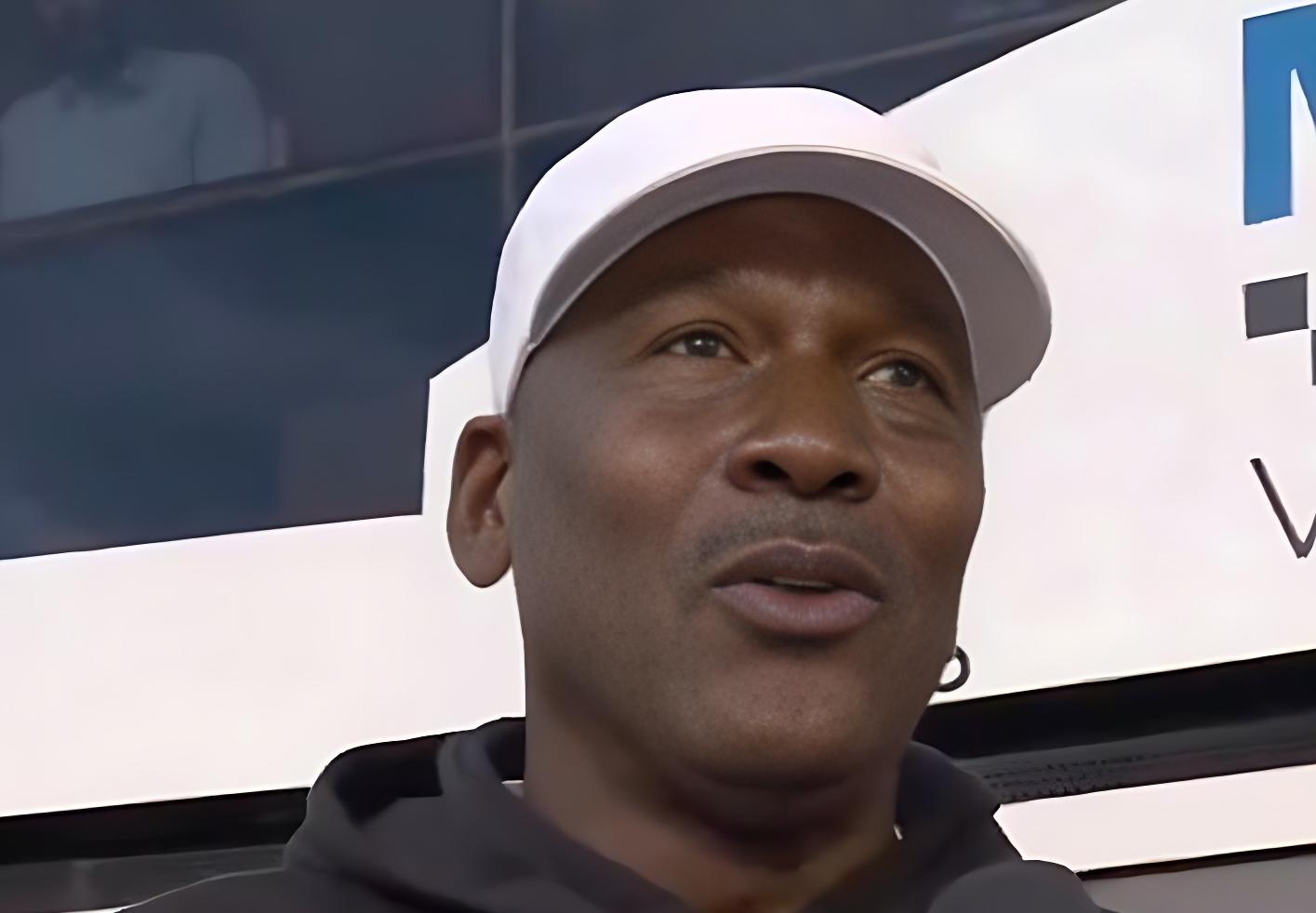

Jean-Baptiste Ondaye was appointed Minister of Financial system and Finance of the Republic of Congo on 22 September 2022.

How do you propose to scale back inequalities, in step with the NDP 2022-26?

The goal of the Nationwide Improvement Plan 2022-26 is to construct a robust, diversified, and resilient economic system, with a view to creating extra wealth and jobs, notably for younger individuals and ladies.

Extra particularly, the 2022-2026 NDP goals to enhance the productive system’s capability to create numerous respectable jobs and generate inclusive progress. Employment and inclusive progress ought to in flip assist to considerably cut back poverty.

As Minister for the Financial system and Finance, what are your ambitions for the Congo and Central Africa?

My imaginative and prescient for the ministerial division for which I’m accountable, below the authority of the President of the Republic and the Prime Minister and as a part of the Authorities Motion Programme, is that it ought to turn into the vector of financial and monetary efficiency by 2026, with trendy governance of public funds.

As a part of the CEMAC Financial and Monetary Reform Programme, now we have carried out high-level missions that led to the organisation of the donors’ roundtable in Paris on the finish of November 2023, to mobilise funding for the second era of CEMAC integration tasks. On the finish of this roundtable, the whole quantity of funding mobilised provisionally stood at 9.21 billion euros, or 104.2% of the funding sought.