Overview:

Whether or not they have an employer-sponsored or government-sponsored medical insurance coverage, People are seeing eye-popping will increase in healthcare prices for subsequent 12 months.

TikTok consumer EbonyElyse has had it with healthcare prices and needed everybody on the app to understand it.

Confronted with skyrocketing healthcare insurance coverage prices — month-to-month premiums for her household will nearly triple, from $480 this 12 months to round $1,500 in 2026, with a $2,000 deductible — she opened her cellphone digital camera, sat in her automobile and vented.

“How can I presumably survive paying $1,500 a month simply in medical protection?!” she stated, including that her employer additionally kicked off spouses who can get medical health insurance on their very own. “And I work in [health care]!! How is that this truthful? How can anyone reside?!”

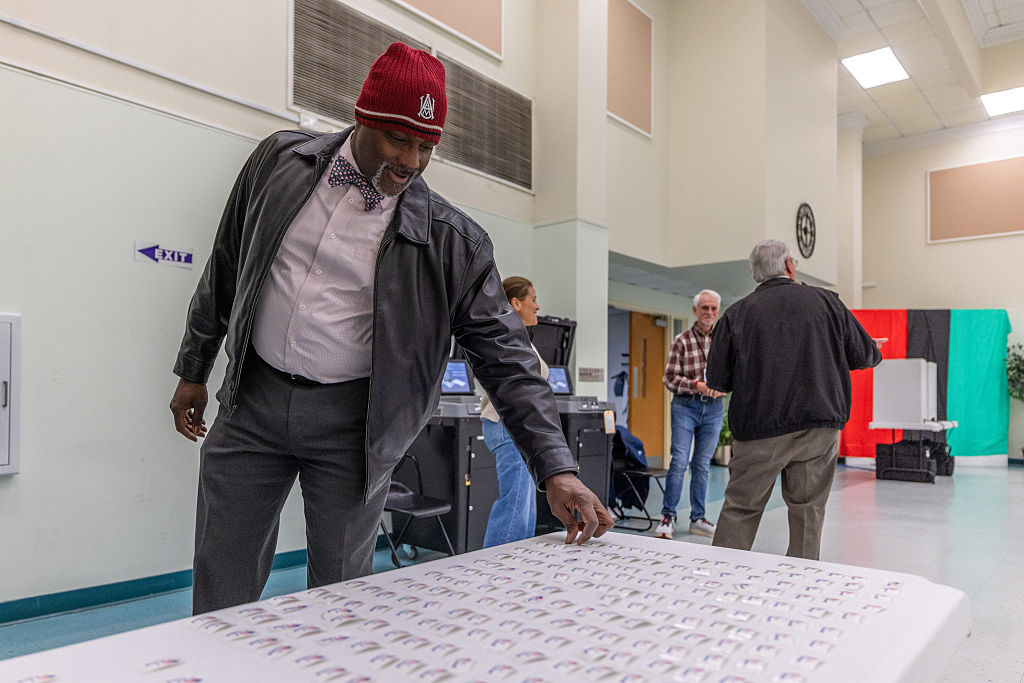

RELATED: As Well being Care Prices Triple, Black Households Pay Even Extra

She’s not alone. As open enrollment season begins for selecting employer-sponsored or government-subsidized medical health insurance, People nationwide are experiencing sticker shock at how far more they’ll pay for medical health insurance within the coming 12 months.

Sen. Raphael Warnock, D-Ga, has additionally taken to social media to sound the alarm about these exploding prices. He says new knowledge present some 2026 plans price nearly $20,000 greater than this 12 months’s. Federal well being care cuts within the One Massive, Stunning Invoice Act that Republicans handed in July are accountable. The Democrats’ refusal to greenlight everlasting cuts to well being care is the primary sticking level between them and Republicans within the authorities shutdown.

Loads of Warning

As People start to really feel the ache of crazy-high healthcare premiums, the stalemate in Congress is on the verge of turning into a full-blown disaster for the Black neighborhood. That’s as a result of Black People face larger charges of persistent illnesses that require fixed administration when in comparison with white folks, together with usually decrease incomes and fewer financial savings, which is able to make the impression of rising healthcare premiums and prices harm much more.

Black American households with employer-sponsored protection are going through a double squeeze: larger premiums, handed alongside from employers, and elevated cost-sharing, all whereas median family revenue for Black households trails the nationwide median.

Consultants say that until Republicans conform to Democrats’ calls for to protect tax subsidies that assist folks pay for Reasonably priced Care Act insurance coverage, and reverse Medicaid cuts in President Donald Trump’s One Massive Stunning Invoice Act — two legislative actions that might maintain total healthcare prices decrease — prices will proceed to soar.

If that occurs, they are saying, some Black people and households face robust selections: pay budget-crushing healthcare premiums and maybe skimp on remedies and prescriptions to economize on out-of-pocket prices, or forego healthcare altogether and danger paying crippling medical payments in the event that they or a beloved one will get sick.

Final 12 months, roughly one-third of adults stated “that previously 12 months they’ve skipped or postponed getting the well being care they wanted due to the associated fee,” in accordance with a KFF Well being Information ballot. The numbers are even worse for the uninsured, with three in 4 uninsured adults beneath age 65 saying they didn’t get wanted medical care due to the associated fee.

The expiring ACA tax credit are just one motive consultants started warning that slicing healthcare applications would ship People’ insurance coverage prices into the stratosphere.

Economists, together with Congress’s personal economics consultants, stated the trillions of {dollars} reduce from Medicaid and different social applications would immediately profit the rich. And public well being advocates have additionally warned that low-income People, together with Black People, will expertise probably the most hurt since their paychecks take a proportionately bigger healthcare chew.

Additionally, Black People face larger charges of persistent illness, together with usually decrease incomes and fewer financial savings, which makes the impression of rising premiums and prices sting much more.

Undercutting the Reasonably priced Care Act

Information from the congressional committee that helps with points on taxation present that 95% of the well being care tax credit go to People incomes lower than $200,000 every year. Households incomes lower than $80,000 per 12 months obtain the overwhelming majority of tax credit.

If the tax credit expire, nearly 5 million People will drop into the ranks of the uninsured, in accordance with the City Institute. The medical health insurance commerce affiliation AHIP argues that it might be a catastrophe.

Thousands and thousands of People “will expertise the unaffordable prices and penalties all through 2026,” AHIP stated in a press release. These embody the monetary ache of “steeply larger out-of-pocket prices for his or her protection every month or by means of the continuing stress of getting misplaced the protection that offered them with entry to high-quality care at a value they may afford.”

However, there may be nonetheless time to guard People from the biggest spike in well being care prices in historical past and to make sure customers see quick aid in 2026,” in accordance with the AHIP assertion.

Outcomes of a KFF Well being Information survey launched Wednesday discovered that the annual medical insurance coverage prices for a household of 4 jumped extra $1,400 this 12 months in comparison with final 12 months.

The KFF survey polled 1,862 private and non-private U.S. employers between January and July 2025, with workforces of at the least 10 folks. KFF knowledge confirmed that roughly 150 million folks beneath age 65 obtain employer-sponsored insurance coverage.

“There’s a quiet alarm bell going off,” Drew Altman, president and CEO of the healthcare coverage nonprofit Kaiser Household Basis, stated in a press release. “Employers don’t have anything new in their arsenal that may handle many of the drivers of their price will increase, and that might nicely end in a rise in deductibles and different types of worker price sharing once more, a technique that neither employers nor staff like however firms resort to in a pinch to maintain down premium will increase.”

Black People enrolled in Medicaid have decrease out-of-pocket prices than people with personal insurance coverage. Enrollees beneath age 65 paid a mean annual out-of-pocket price of $236, in contrast with about $656 for folks in the identical age group with personal insurance coverage.

Employers surveyed by KFF most frequently stated prescription drug costs contributed most to price will increase.

Premiums for households have risen nearly 26% since 2020, and KFF stated will increase will most likely proceed subsequent 12 months if employers can’t discover methods to decrease their prices.