Reciprocal tariff coverage creates disproportionate burden on working households and entrepreneurs

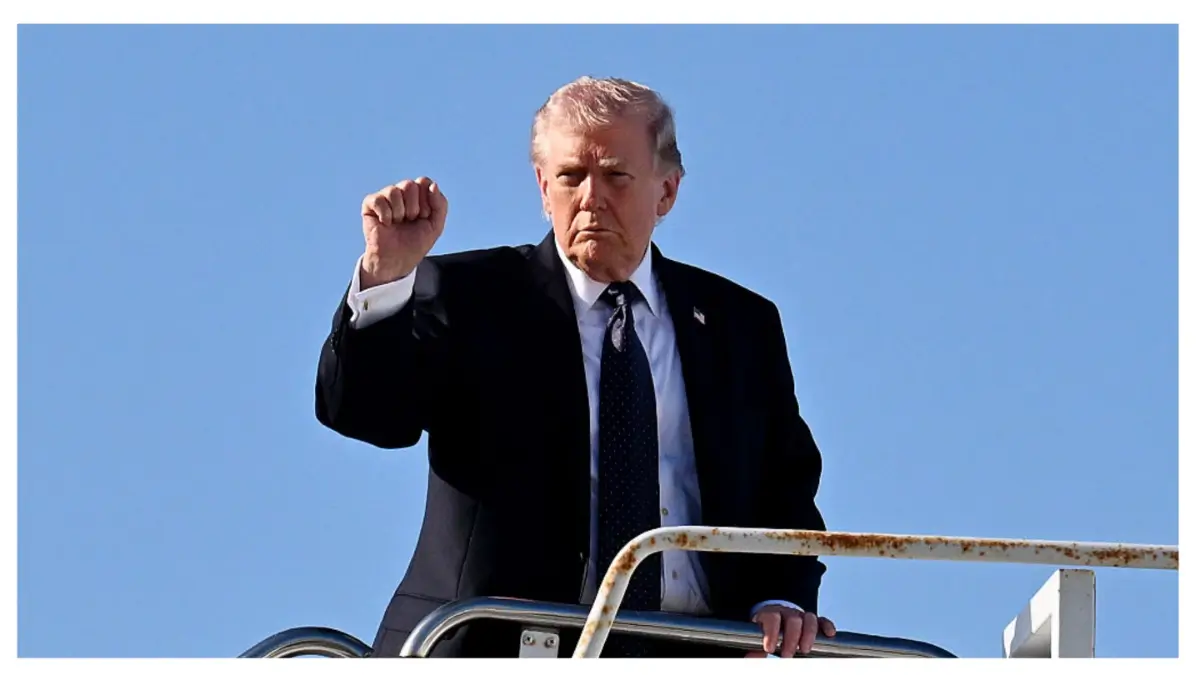

President Trump’s sweeping new tariff coverage formally launched right now, and whereas Washington debates commerce technique, the actual penalties are already being felt in communities throughout America — significantly in Black households and neighborhoods the place each greenback counts and financial margins are razor-thin.

The reciprocal tariff system concentrating on 92 international locations with import duties starting from 10% to 41% impacts main buying and selling companions together with Canada, South Africa, India, Brazil and Taiwan. These tariffs don’t simply impression summary commerce flows — they immediately enhance prices on on a regular basis necessities that Black households rely on most.

The grocery retailer actuality test

Black households already face systemic revenue and wealth gaps that make them extra weak to cost will increase on fundamental requirements. When tariffs drive up prices on imported meals gadgets, electronics, clothes and medical provides, these households really feel the impression instantly and intensely.

The consequences hit hardest in classes the place Black households already spend disproportionate parts of their revenue — meals, transportation and important items. A single mom managing a good funds all of the sudden faces larger costs on every part from youngsters’s clothes to family fundamentals, with no corresponding enhance in revenue to offset the extra prices.

For households residing paycheck to paycheck, even seemingly small worth will increase can drive tough selections between requirements, creating ripple results that reach far past the preliminary tariff impression.

Black entrepreneurship underneath strain

The tariff burden extends past customers to strike immediately at Black-owned companies which have change into very important engines of neighborhood financial improvement. Many Black entrepreneurs run companies that rely on imported items or parts, from vogue boutiques to magnificence provide shops to specialty meals operations.

These companies usually function with slim revenue margins that depart little room to soak up sudden value will increase. When suppliers elevate costs in a single day because of tariff impacts, Black enterprise homeowners face not possible selections — take in the prices and threat monetary pressure, or go will increase on to prospects who could not be capable of afford larger costs.

The timing is especially difficult given the progress Black entrepreneurship has made lately. Small companies that survived the pandemic and constructed momentum are actually going through a brand new financial headwind that threatens their stability and progress prospects.

Employment vulnerability in key industries

The industries most certainly to expertise job slowdowns because of tariff impacts — retail, transportation, logistics and warehousing — make use of excessive numbers of Black staff, significantly in metropolitan areas. These sectors have historically offered steady employment alternatives for staff with out school levels.

If firms scale back operations because of larger import prices or disrupted provide chains, the ensuing job losses or lowered hours will disproportionately have an effect on Black staff who’re concentrated in these industries. The potential for slower wage progress in these sectors provides one other layer of financial strain.

This employment vulnerability is very regarding given the features Black staff have made lately and the significance of those industries as pathways to middle-class stability for a lot of households.

Compound results of financial inequality

The tariff impacts compound present financial disparities that Black communities face. Decrease common wealth ranges imply much less monetary cushion to soak up worth will increase. Greater charges of small enterprise possession in affected industries imply better publicity to provide chain disruptions.

Geographic focus in city areas the place import-dependent retailers and providers function means Black communities usually lack various purchasing choices when costs rise. The mixture creates an ideal storm of financial strain that falls heaviest on these least outfitted to deal with further monetary stress.

Coverage guarantees versus sensible actuality

The Trump administration argues that tariffs will ultimately profit American staff by forcing fairer commerce offers and reviving home manufacturing. Nevertheless, the quick actuality for Black households and companies is elevated prices with no corresponding advantages.

The timeline for any potential manufacturing job creation extends far past the quick worth impacts that households are experiencing right now. This mismatch between long-term coverage targets and short-term financial ache creates specific hardship for communities that may’t afford to attend for theoretical future advantages.

Restricted coverage response choices

In contrast to different financial challenges which may immediate focused reduction applications or neighborhood assist initiatives, tariff impacts are constructed into the value construction of products and providers. There’s no meals stamp program for tariff-inflated costs or small enterprise mortgage program particularly for import value will increase.

This implies Black communities and companies should take in these prices via lowered consumption, smaller revenue margins or each — outcomes that perpetuate and probably worsen present financial disparities.

Trump’s new tariffs create a regressive tax that hits Black communities hardest exactly the place they’re most weak — in family budgets, small enterprise operations and employment sectors which have offered financial alternative. Whereas commerce coverage debates concentrate on macro-economic idea and worldwide relations, the sensible impression falls disproportionately on communities that may least afford further financial strain, elevating basic questions on who actually bears the price of America’s commerce wars.