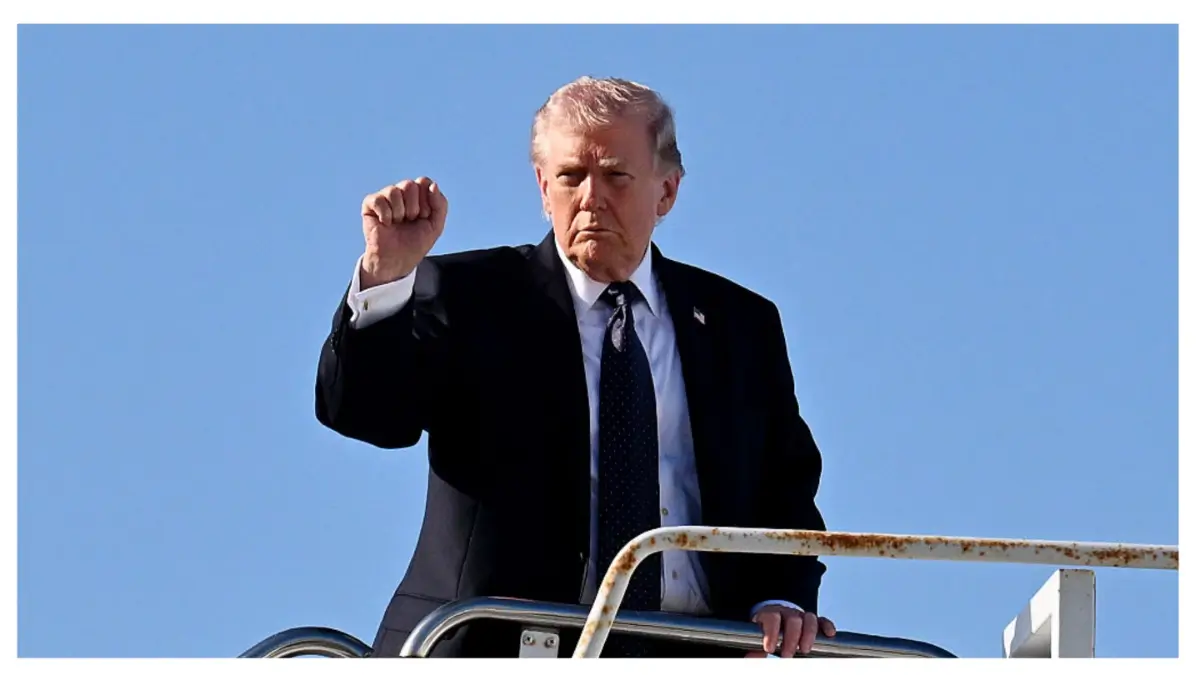

The president indicated he has begun the interview course of and should already know his choice, although Treasury Secretary Scott Bessent continues to say no the position.

President Trump advised Tuesday that he has already recognized his most popular candidate to steer the Federal Reserve, revealing that the interview course of for the nation’s strongest financial place has begun in earnest. Talking with reporters from the Oval Workplace, the president conveyed confidence that he is aware of who will exchange Jerome Powell when the present Fed chair’s time period concludes in Could.

The announcement got here because the administration works via a fastidiously curated checklist of potential successors for a task that wields monumental affect over rates of interest, inflation and the broader trajectory of the American economic system. The subsequent Fed chair will inherit an establishment navigating advanced challenges together with persistent inflation considerations, international financial uncertainty and mounting political stress from the White Home.

The reluctant frontrunner declines once more

Trump indicated he stays drawn to Treasury Secretary Scott Bessent for the place, regardless of the secretary’s repeated insistence that he doesn’t need the job. The president acknowledged Bessent’s reluctance throughout his remarks, expressing admiration for the Treasury chief whereas accepting that he’ll possible refuse the nomination if supplied.

Bessent has been instrumental in orchestrating the choice course of itself, main interviews with candidates and establishing the timeline for ultimate selections. The secretary advised that Trump would conduct sit down conferences with shortlisted candidates within the coming days, with second spherical interviews anticipated to wrap up by Thanksgiving. This schedule signifies the administration hopes to announce a nominee comparatively rapidly, permitting for Senate affirmation hearings earlier than Powell’s departure.

The reluctance of Bessent, extensively revered in monetary circles for his market acumen and coverage experience, leaves the president weighing different choices from a various pool of candidates. Trump hinted that his eventual alternative may shock observers, although he additionally left open the opportunity of deciding on somebody from the extra typical checklist of names circulating in Washington.

5 contenders emerge from the shortlist

The administration has narrowed the sector to 5 severe candidates, every bringing distinct {qualifications} and views to the desk. Fed governors Chris Waller and Michelle Bowman signify continuity decisions, each at present serving on the central financial institution’s Board of Governors and intimately aware of its operations and tradition.

Former Fed governor Kevin Warsh brings prior expertise from his earlier tenure on the establishment, having served throughout the monetary disaster period. His return would sign a desire for somebody who has already navigated the interior dynamics of the Fed throughout turbulent financial occasions.

Kevin Hassett, at present serving as Nationwide Financial Council Director, affords a unique profile as somebody deeply embedded within the Trump administration’s financial policymaking equipment. His choice would signify a extra overtly political alternative, probably elevating considerations amongst Fed watchers about central financial institution independence.

Rick Rieder, BlackRock’s head of mounted earnings, would convey personal sector credibility and intensive market expertise to the position. His background managing one of many world’s largest funding portfolios may enchantment to an administration that values enterprise experience.

Powell’s unsure ultimate months

Trump didn’t conceal his frustration with Powell, expressing a need to take away the present chair instantly whereas acknowledging that others in his orbit have recommended endurance. The president’s rocky relationship with Powell dates again years, marked by public criticism of the Fed’s rate of interest selections and financial coverage strategy.

Powell has maintained the central financial institution’s conventional independence all through his tenure, typically charting a course at odds with White Home preferences. This dynamic has created persistent pressure between the administration and the Fed, with Trump viewing Powell as insufficiently aware of political and financial realities.

The approaching months will take a look at whether or not Trump opts for what he termed a politically appropriate alternative or surprises observers with a much less typical choice. Both manner, the choice will form American financial coverage for years to return and sign how the administration views the fragile stability between central financial institution independence and government department affect over financial affairs.