Although a Republican-led tax invoice increasing President Donald Trump’s 2017 tax cuts, amongst different tax and spending provisions, was stalled in Congress on Friday, Black elected leaders, advocates, and tax specialists are nonetheless sounding the alarm on the plan that they are saying largely advantages billionaires and threatens the livelihoods of Black Individuals.

Republicans within the U.S. Home of Representatives will proceed to work on the controversial reconciliation invoice by the weekend. Home Speaker Mike Johnson hopes to advance it to a flooring debate subsequent week. The tax and spending laws contains President Trump’s high priorities, together with a everlasting growth of his 2017 tax cuts, main cuts to social packages, together with well being care, and elevated spending for army and ICE operations, and border safety.

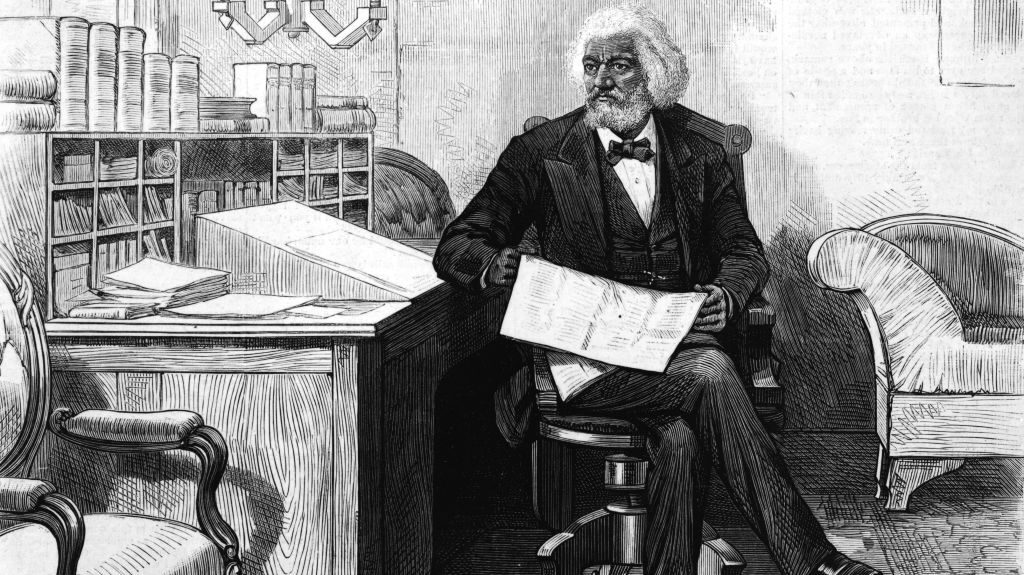

“Trump’s price range is prone to hurt Black Individuals probably the most,” mentioned NAACP President Derrick Johnson. He advised theGrio, “His price range is asking for $15 billion in cuts to the Division of Schooling, the company that enforces civil rights legal guidelines in American faculties. He desires to chop $18 billion of help to the Nationwide Institute of Well being, which incorporates packages associated to public well being in communities of shade. And he desires to chop $26 billion from the rental help program, together with Part 8.”

Most alarming to advocates, the Trump-GOP tax and spending invoice requires steep cuts to Medicaid, totaling a whole bunch of thousands and thousands, and likewise requires work necessities for recipients.

U.S. Senator Lisa Blunt Rochester, D-Del., warned that the tax and price range laws would “take away well being take care of thousands and thousands of Individuals and shut down hospitals throughout the nation.” The senator advised theGrio, “We nonetheless have main well being disparities in America, from Black maternal mortality charges going as much as Black Individuals being extra at-risk for persistent well being situations or dying from treatable diseases.”

Blunt Rochester added, “This invoice isn’t just unhealthy coverage, it will make it that a lot tougher to lastly shut well being care gaps and enhance the standard of life for Black Individuals.”

Whereas some provisions of the tax price range plan, like increasing the Youngster Tax Credit score and never taxing ideas and time beyond regulation pay, could also be celebrated, Michael Linden, government director of Households Over Billionaires, advised theGrio, “It’s a switch of revenue and wealth from Black and brown communities into way more predominantly white households.”

In line with a New York Instances report, whereas most Individuals may see decrease taxes if the invoice is handed into regulation, the hostile results of the spending cuts proposed by Republicans would outweigh any tax advantages.

Linden famous that the estimated $4 trillion tax cuts would largely go to the nation’s “richest 5%,” including, “That’s not simply cash that can fall out of the sky. That could be a price that everyone else goes to have to select up [and] we all know that the associated fee goes to finish up falling disproportionately on Black folks.”

“Extending all of those tax cuts for wealthy folks and firms is extremely costly, and it places huge strain on different areas of the federal price range,” Linden defined. “What occurs is Congress then says, properly, we are able to’t afford to put money into well being care or housing or training. We now have to chop these issues as a result of there’s not sufficient cash anymore.”

Black Individuals disproportionately depend on federal help and social security web packages. To not point out, U.S. Census Bureau information reveals that whereas white households noticed their incomes improve on common, Black households remained flat. The truth is, Black and Hispanic households remained the bottom in earnings amongst all racial and ethnic teams, with median incomes of $56,490 and $65,540, respectively.

As a substitute of passing large tax cuts that can largely profit rich Individuals, advocates level to a rising political motion to lift taxes on the wealthy. In line with Pew Analysis Heart, a majority of Individuals (63%) say firms and households making over $400,000 ought to see greater taxes.

“They suppose that they’re capable of pull the wool over folks’s eyes and make it about, you understand, fraud or waste or abuse,” Linden mentioned of the Republican financial agenda. “To be clear, there may be fraud, waste, and abuse within the federal price range. Numerous it, by the best way, is within the tax code, not in Medicaid and Medicare and Social Safety.”

NAACP President Johnson instructed an irony within the Trump administration’s mass firing of federal staff and main spending packages within the identify of eliminating so-called fraud and waste. Referring to Trump advisor and proprietor of Tesla, Elon Musk, Johnson mentioned the president “colluded with an unelected billionaire to chop funding for very important packages throughout the nation. Now, he’s pushing for price range cuts that can devastate thousands and thousands of Individuals.”

Johnson advised theGrio, “If we’re not cautious, this administration will steal our advantages paid for by hard-working folks.” He added, “It’s time to remind Congress that as an alternative of awarding billionaires much more cash, they need to struggle to guard the hard-working Individuals who’ve paid for the correct to retire with dignity, to obtain healthcare, and to feed their kids.”