The healthcare world simply bought a significant shock as UnitedHealth Group, the huge insurance coverage and healthcare providers behemoth, finds itself abruptly with out a captain. CEO Andrew Witty’s surprising resignation has despatched ripples by means of the business and left traders clutching their pearls as the corporate concurrently pulled its monetary steerage for subsequent yr. Speak about leaping ship throughout tough waters.

The management earthquake

In a transfer that has business insiders elevating eyebrows, UnitedHealth introduced CEO Andrew Witty’s departure with the company equal of “it’s not you, it’s me.” The obscure clarification citing “private causes” has executed little to calm nerves because the healthcare large’s inventory took an instantaneous hit.

The timing couldn’t be extra suspicious. Witty’s exit comes exactly when the corporate is battling monetary headwinds from an surprising surge in medical claims. Relatively than weathering the storm, the captain seems to have grabbed a lifeboat, leaving traders and workers alike questioning what he would possibly know that they don’t.

In response, the corporate’s board has summoned former CEO Stephen Hemsley from his board chairman position to retake the helm briefly. It’s like calling your ex throughout an emergency—a transfer that may present fast consolation however raises apparent questions on whether or not there was a greater plan out there.

The Medicare cash pit

Behind the management drama lies a extra elementary problem—UnitedHealth’s Medicare Benefit enterprise is experiencing a severe case of economic indigestion. This system, which provides privately managed Medicare plans to seniors, has been a significant development engine for the corporate. Sadly, it’s now burning gasoline sooner than anticipated.

The issue is refreshingly easy but financially devastating. Extra seniors than projected are literally utilizing their medical insurance to get healthcare. Revolutionary idea, proper? After years of fastidiously calibrated projections about how typically members would search medical care, UnitedHealth is discovering that its math might need been overly optimistic.

This utilization spike has pressured the corporate to withdraw its 2025 monetary steerage fully—company communicate for “we do not know how a lot cash we’re going to make subsequent yr.” For an organization that prides itself on predictability and regular development, this uncertainty represents a big credibility hit.

The pandemic aftershocks

A part of UnitedHealth’s present predicament stems from the unpredictable aftermath of the pandemic. Healthcare utilization patterns went haywire throughout COVID—first plummeting as folks averted medical settings, then rebounding as delayed care lastly caught up.

The corporate’s actuaries, these masters of healthcare fortune-telling, seem to have misinterpret the tea leaves. They predicted a gradual return to regular patterns, however as an alternative, they’re seeing sustained increased utilization, notably amongst Medicare members who could have postponed important care in the course of the pandemic years.

This miscalculation isn’t only a minor accounting hiccup. For well being insurers, precisely predicting medical prices is the complete ballgame. When these predictions miss by sufficient proportion factors, revenue margins can rapidly evaporate, turning what appeared like a profitable line of enterprise right into a monetary albatross.

The Wall Road fear

Buyers, by no means recognized for his or her endurance with uncertainty, reacted predictably to the one-two punch of management change and monetary steerage withdrawal. UnitedHealth’s inventory took a severe hit, erasing billions in market worth sooner than you’ll be able to say “surprising CEO resignation.”

The market response displays a deeper nervousness. UnitedHealth has lengthy positioned itself because the regular, dependable large within the healthcare house—the blue-chip funding that delivers constant returns whereas navigating the business’s infamous complexity. That fastidiously cultivated picture has suffered a big blow.

Analysts at the moment are elevating uncomfortable questions in regards to the firm’s capability to cost its Medicare Benefit merchandise appropriately, handle medical prices successfully, and preserve its market-leading place as rivals circle. The management vacuum solely amplifies these considerations, creating an impression of an organization abruptly enjoying protection somewhat than confidently increasing its empire.

The unintentional interim

Stephen Hemsley, the corporate’s chairman and former CEO, now finds himself again within the govt suite in what was certainly not a part of his retirement plan. Having led UnitedHealth by means of years of enlargement from 2006 to 2017, he’s being requested to regular the ship throughout this second of turbulence.

Hemsley’s return would possibly reassure some stakeholders who bear in mind his tenure as a interval of serious development and strategic readability. Nevertheless, it additionally raises uncomfortable questions on succession planning. Why wasn’t there a transparent inside candidate able to step up? Has the corporate’s management bench been thinner than it appeared?

The interim association buys time however creates its personal uncertainty. How aggressively can a short lived chief make strategic modifications to deal with the underlying monetary challenges? Will Hemsley be merely a caretaker, or will he provoke extra elementary reforms throughout his surprising encore efficiency?

The tragic backdrop

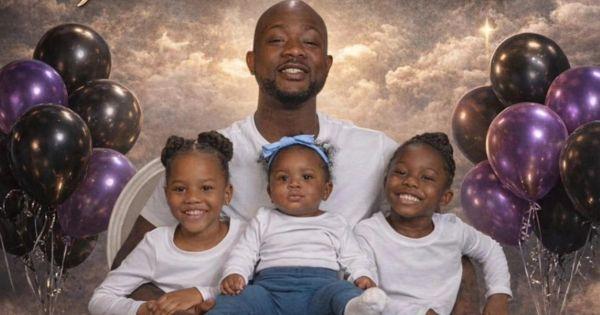

Including one other layer of complexity to this company drama is a real tragedy. The latest deadly capturing of UnitedHealthcare CEO Brian Thompson has forged a shadow over the group, creating emotional pressure all through its management ranks.

Whereas indirectly linked to Witty’s departure, this surprising occasion has undoubtedly contributed to a way of instability throughout the firm. Organizations, like folks, can discover it troublesome to course of a number of important disruptions concurrently, and UnitedHealth is navigating each operational challenges and private loss.

The human dimension of this management change can’t be neglected. Past spreadsheets and inventory costs, UnitedHealth is a corporation of people that have skilled trauma and upheaval. How the corporate helps its workforce by means of this era could show as essential as its monetary maneuvers.

The business implications

UnitedHealth’s challenges haven’t emerged in isolation. Throughout the medical insurance panorama, corporations are grappling with related utilization pressures, notably in Medicare Benefit applications the place competitors for seniors is fierce and pricing errors will be pricey.

The corporate’s stumble could sign broader business recalibration. After years of sturdy development and profitability in Medicare Benefit, insurers could must reset expectations about sustainable margins on this market phase. This might set off ripple results from premium will increase to learn design modifications for hundreds of thousands of seniors.

UnitedHealth’s sheer measurement—it covers extra People than another personal insurer—means its methods typically set business benchmarks. If the corporate pulls again from aggressive Medicare Benefit development or considerably restructures its choices, rivals could comply with go well with, reshaping this very important marketplace for older People.

The regulatory radar

UnitedHealth’s present predicament arrives in opposition to a backdrop of elevated regulatory scrutiny. Authorities officers have been analyzing Medicare Benefit plans with rising concern about all the things from advertising practices to danger adjustment funds.

The corporate’s admission that it misjudged utilization patterns may appeal to undesirable consideration. Regulators would possibly query whether or not its Medicare Benefit pricing methods have been sustainable or whether or not it was providing advantages that appeared enticing on paper however assumed unrealistically low utilization.

This regulatory dimension provides one other layer of complexity to the management transition. Any new everlasting CEO might want to navigate not simply operational challenges however potential coverage modifications that might basically alter the Medicare Benefit panorama.

The trail ahead

Regardless of these challenges, UnitedHealth stays an unmatched drive in American healthcare. Its mixture of insurance coverage protection, doctor practices, surgical procedure facilities, information analytics, and pharmacy advantages offers it unparalleled scale and integration.

The corporate’s fast precedence will likely be restoring market confidence by means of transparency about its Medicare Benefit challenges and a reputable plan to deal with them. This would possibly embody extra conservative pricing for 2026 plans, profit changes, or enhanced medical administration applications.

Concurrently, the board should conduct a radical CEO search that balances the necessity for contemporary perspective with deep business information. The following chief will inherit each important challenges and noteworthy property—together with an organization that touches almost each facet of the healthcare ecosystem.

The management lesson

UnitedHealth’s present turbulence provides a reminder that even the mightiest healthcare organizations stay susceptible to elementary business challenges: precisely predicting healthcare utilization, managing prices successfully, and balancing development with sustainability.

For stakeholders throughout healthcare, this example demonstrates how rapidly confidence can erode when management continuity and monetary predictability are concurrently disrupted. Organizations that satisfaction themselves on stability want succession plans as strong as their steadiness sheets.

Because the mud settles, UnitedHealth faces a vital inflection level. Its response to this management transition and monetary reset will decide whether or not this era represents a short lived setback or the start of a more difficult chapter for considered one of healthcare’s most influential corporations.