For some debtors nationwide, scholar mortgage funds could quickly be a factor of the previous. That’s as a result of on Thursday, the Supreme Court docket declined to dam a category motion lawsuit towards predatory for-profit schools and vocational faculties. The choice permits a virtually $6 billion authorized settlement to maneuver ahead and permits the cancellation of scholar loans for 1000’s of debtors who beforehand claimed their faculties misled them.

The settlement, which stems from a class-action case, was filed in 2019 and particularly focused Everglades School, Lincoln Academic Providers Corp., and American Nationwide College. These faculties argued they have been unfairly included within the listing of about 150 faculties alleged with wrongdoing, a lot of which have been for-profit. Everglades School is a not-for-profit.

Different schools embrace Corinthian Schools, Inc., ITT Technical Institute, and extra.

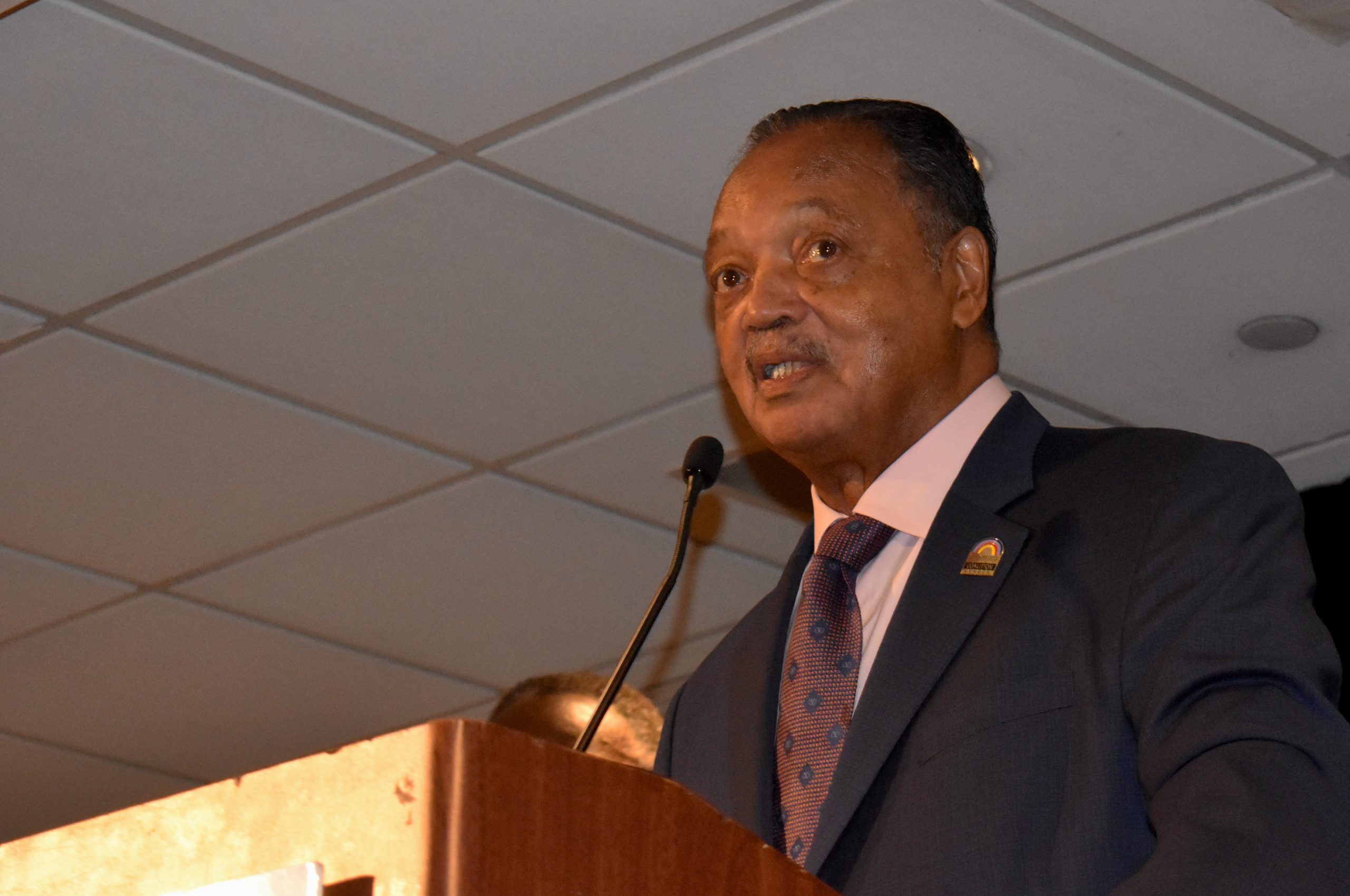

This settlement is essential for Black and Latino people, who usually tend to be focused by for-profit faculties by way of predatory practices and redlining. Areas thought of majority-Black have been “over 75% extra prone to have a for-profit school,” in keeping with the Pupil Borrower Safety Heart.

Pupil mortgage debt is a matter for the Black neighborhood due to its affect on the flexibility to succeed in main monetary milestones, equivalent to beginning a enterprise or shopping for a house. The unbalanced quantity of scholar mortgage debt that impacts Black debtors was cited many instances within the White Home’s truth sheet on the problem.

As of 2022, Individuals owe $1.75 trillion in scholar loans. Black people with bachelor’s levels “have a mean of $52,000 in scholar mortgage debt,” in keeping with the Training Information Initiative.

Within the case of for-profit faculties, the Brookings Institute present in 2021 that for-profit schools enroll about 10% of scholars nationally, and people college students account for half of all scholar mortgage defaults. They’re additionally extra prone to borrow federal loans in comparison with college students at four-year public schools.

In March 2021, the Division of Training below the Biden administration forgave $1 billion in federal scholar loans for 72,000 debtors who have been college students of for-profit schools.

Debtors proceed to attend for a call from the Supreme Court docket on the bigger mortgage forgiveness program that might have an effect on greater than 40 million folks and wipe out greater than $400 billion in scholar mortgage debt.