I’m 32, and for so long as I can bear in mind, I’ve heard about how Social Safety was on its approach to being depleted. It’s been a recognized difficulty, but there’s been no significant laws to handle it. In consequence, rising well being prices and up to date laws have led to the projected “go-broke” date shifting up for each Social Safety and Medicare.

In line with AP, an annual report launched on Wednesday tasks the go-broke date for the Social Safety belief will happen in 2034, a yr up from final yr’s projection of 2035. For Medicare, the brand new date was a bit extra drastic, going up from 2036 to 2033.

Now, to be clear, the go-broke date doesn’t imply advantages will likely be stopped outright. It merely means payouts will likely be given at a lowered fee.

For Social Safety, it’s estimated that profit payouts can be capped at 81 p.c, and for Medicare, the federal government supplied medical health insurance that covers individuals age 65 and older, it’s estimated that funds would solely cowl 89 p.c of prices for sufferers’ hospital visits, hospice care, and nursing residence stays. This discount would considerably have an effect on the 68 million Individuals at present enrolled in Medicare,

The Social Safety and Medicare belief funds are overseen by 4 trustees. The Treasury Secretary serves as managing trustee, with the Secretaries of Labor, Well being and Human Providers, and the Commissioner of Social Safety being the opposite three. The trustee board technically has two different presidentially-appointed and Senate-confirmed trustees who function public representatives, however these roles have been empty for over a decade.

“Present-law projections point out that Medicare nonetheless faces a considerable monetary shortfall that must be addressed with additional laws. Such laws needs to be enacted sooner fairly than later to attenuate the affect on beneficiaries, suppliers, and taxpayers,” the trustees state within the report.

The go-broke date for Social Safety has fluctuated fairly a bit in recent times, with annual reviews from latest years projecting “go-broke” dates in 2026, 2028, and 2031, respectively.

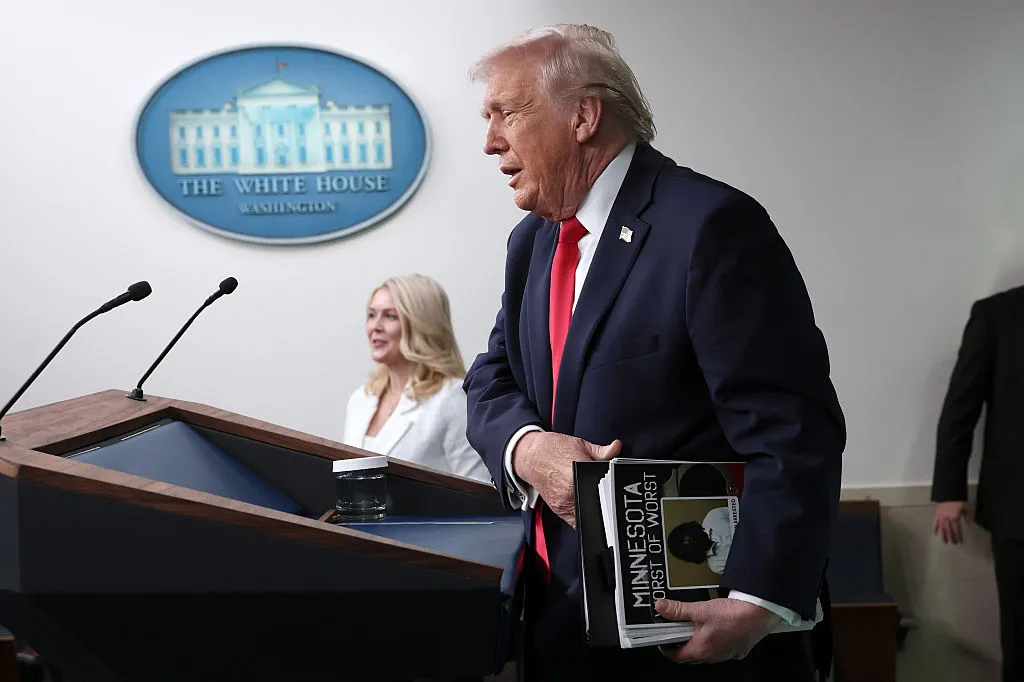

A ballot carried out by AP final month revealed that 3 in 10 Individuals over 60 are usually not assured that Social Safety advantages can be there for them in the event that they wanted them. Clearly, this information gained’t do a lot to extend their confidence. Social Safety Administration Commissioner Frank Bisignano, who was solely sworn into his position final month, launched an announcement saying that “the monetary standing of the belief funds stays a prime precedence for the Trump Administration.”

This looks like one other occasion of the Trump administration being all discuss, little motion, as there appears to be little or no significant laws to handle the difficulty. Actually, Trump’s “Huge, Lovely” funds invoice has little or no in the way in which of reduction for Social Safety and Medicare.

As a millennial with little or no religion in America’s skill to enhance upon itself, I’d very very similar to it if I might choose out of paying Social Safety as a result of whereas I’m not over 60, I’ve little or no religion that the advantages are going to be there for me by the point I can use them. Heck, on the fee we’re going, I’d actually simply be joyful if we also have a useful democracy at that time.

SEE ALSO:

Trump’s ‘Huge, Lovely Invoice’ Will Destroy Medicare, Meals Stamps

Pupil Mortgage Collections Make American Credit score Scores Plummet

Social Safety Projected To “Go-Broke” Earlier Than Anticipated

was initially revealed on

newsone.com