Nigeria’s central financial institution has abolished the nation’s a number of alternate charge system and successfully floated the naira forex, the financial institution stated, as new President Bola Ahmed Tinubu revamps the nation’s financial insurance policies.

Economists, the World Financial institution and IMF had lengthy urged Nigeria to desert the complicated alternate mechanism and capital controls put into place underneath former President Muhammadu Buhari as a solution to encourage funding in Africa’s largest financial system and high oil producer.

ALSO READ: Nigeria launches eNaira digital forex

In a press release late Wednesday, the Central Financial institution of Nigeria stated it had ended the “segmentation” of foreign exchange markets, with transactions to be carried out solely by way of one so-called “Traders and Exporters” class.

The naira may even be traded at a “prepared purchaser, prepared vendor” market charge as a substitute of regulated charges in opposition to the US greenback and different currencies, the assertion stated.

“All segments at the moment are collapsed into the Traders and Exporters window,” it stated in a press release posted on its web site.

The naira forex had formally traded at round 460 to the greenback final week, however by the top of official commerce on Wednesday it had closed at round 660 to the greenback, based on native merchants and analysts.

“It’s successfully each a devaluation in addition to a deregulation,” stated Tunde Ajileye, an analyst at Nigeria’s SBM Intelligence.

“Lots of the market distortions that have been there as a result of the central financial institution and the Nigerian authorities have been attempting to regulate the FX value, will go. So its constructive.”

The controls had created a again up in demand for overseas forex and a thriving black market or parallel commerce the place the naira was promoting at round 750 to the buck.

Alternate charge

ALSO READ: Nigeria suspends anti-corruption chief pending investigation

Overseas airways working in Nigeria, for instance, had usually complained of their incapacity to expatriate hundreds of thousands of {dollars} of their earnings due to the controls.

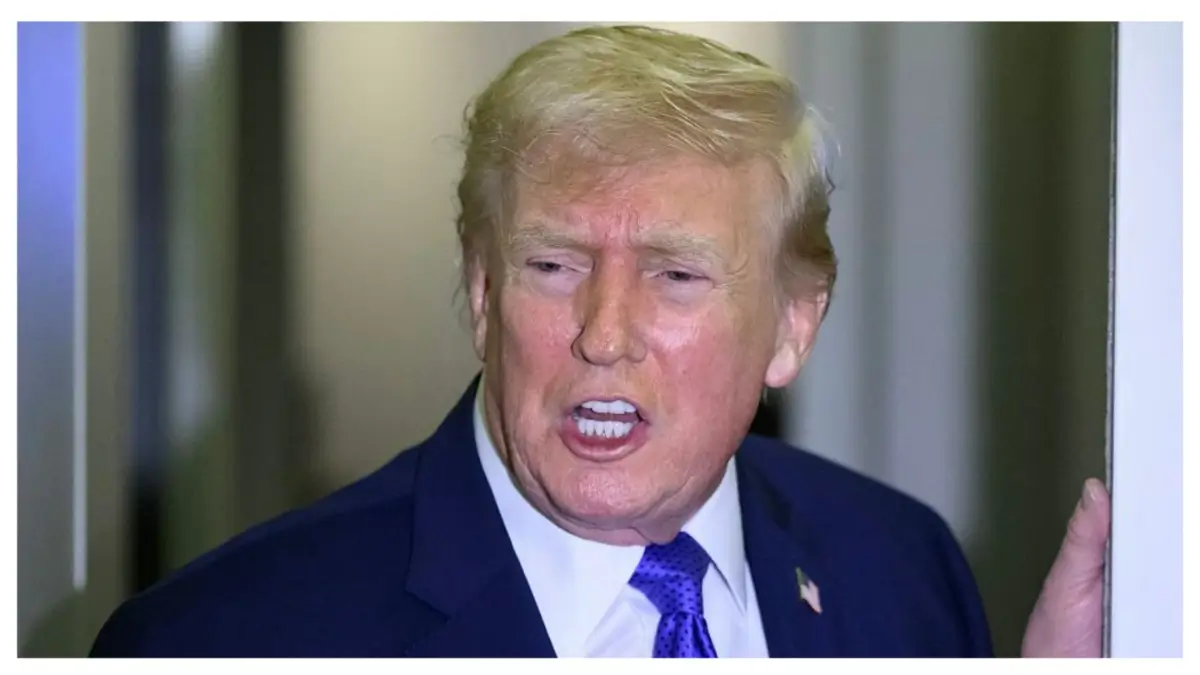

The foreign exchange shakeup is only one of a raft of selections taken by former Lagos State governor Tinubu since he got here to presidency two weeks in the past promising reforms to revitalise the financial system of Africa’s most populous nation.

On his Could 29 inauguration, Tinubu ended the nation’s long-standing subsidy on petrol costs to maintain them artificially low however which price of billions of {dollars} for the cash-strapped authorities.

ALSO READ: Nigerians urged to stay affected person over the excessive gas costs

Gasoline costs virtually tripled throughout Nigeria after Tinubu introduced that subsidies have been “gone”, however most analysts say the measure was wanted to finish to assist the federal government lower spending.

Every week in the past, Tinubu’s authorities additionally suspended the nation’s central financial institution chief who was later detained by home safety companies as a part of an investigation into his time in workplace.

ALSO READ: Local weather change: Nigeria’s want for motion, methods to start with

Tinubu on Wednesday additionally suspended the nation’s anti-corruption chief as a part of an investigation into allegations of abuse of workplace, the federal government stated, and he was later questioned by home safety companies.

pma/rl

© Agence France-Presse