by Kandiss Edwards

June 25, 2025

The Monetary Wellness Collaborative obtained the $1 million grant to assist small companies handle their monetary well being and scale-up.

JPMorgan Chase has dedicated $1 million to assist three New Orleans non-profit organizations.

The Monetary Wellness Collaborative obtained funds to assist bolster its total mission of offering small companies with hands-on instruments to handle their monetary well being. Monetary Wellness Collaborative consists of nonprofit Propeller, Thrive New Orleans, and Fund 17, NOLA reported. Launching in 2022, JPMorgan Chase has given the collaborative its most important funding thus far.

Victoria Adams Phipps, Vice President of World Philanthropy at JPMorgan Chase, spoke on the June 24 ceremony. Phipps praised the work that the Monetary Wellness Collaborative has already completed. She famous that the Propeller group was proactive in its pursuit of JPMorgan Chase’s funding, and it has paid off.

“We supported that preliminary pilot of the work again in 2022, and we have been thrilled to see that the mannequin labored,” she stated.

Phipps additionally famous that the power to acquire capital for scaling up has been a constant concern locally. She is assured within the instruments provided by the Monetary Wellness Collaborative, and “constructing relationships over time” was the lacking key for a lot of of New Orleans’ small companies. With the assist of Propeller, Thrive New Orleans, Fund 17, and JPMorgan Chase, over 400 companies have taken the following step of their development.

“Most of the firms they have been in dialog with have been missing crucial inputs that have been essential to facilitate development,” she stated. “That may have been entry to networks, experience or clients. However for a lot of of them, it was entry to capital that was hindering their progress.”

The grant allows the Monetary Wellness Collaborative to proceed providing companies to entrepreneurs, together with monetary teaching, credit score counseling, mortgage bundle preparation, accounting help, and assist for acquiring credentials.

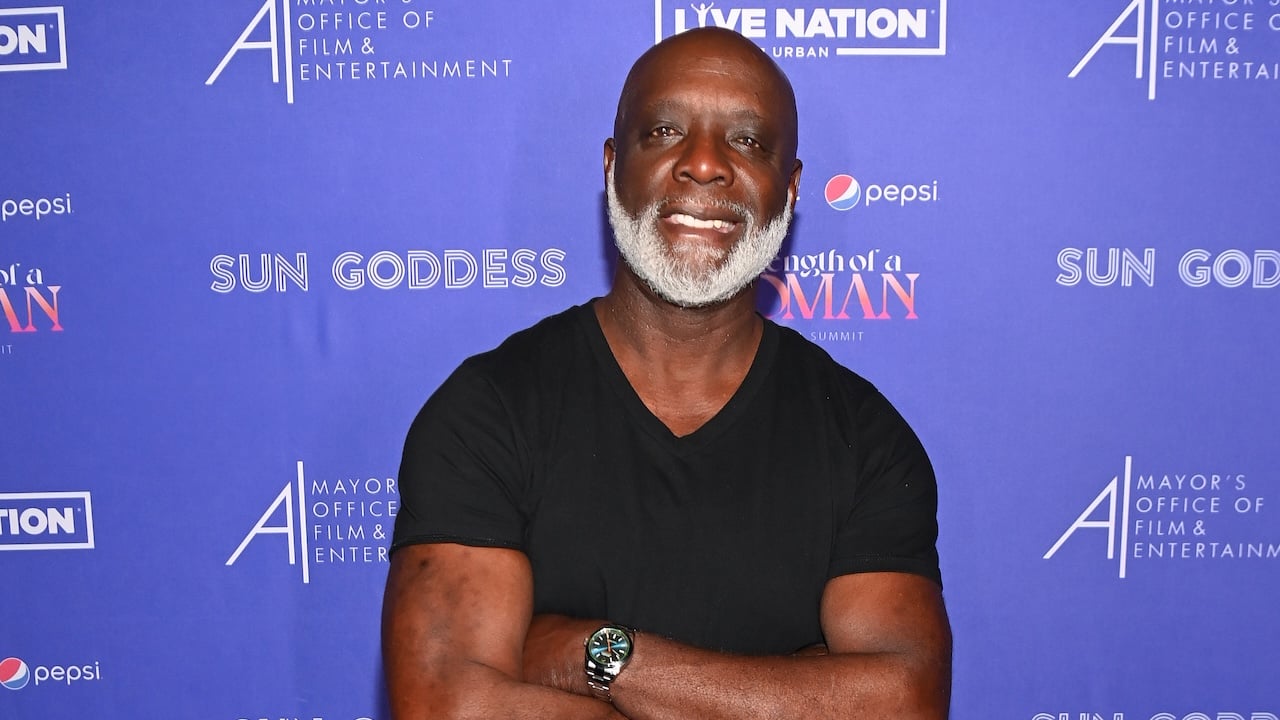

Former recipient of this system, Travis Williams of Nola Steele, spoke extremely of the companies supplied. Based on Steele, he was in a position to arrange his operations and safe funding after gaining help.

“We now have nice credit score scores, and now we have nice relationships with different banks, but we weren’t in a position to get the monetary backing that we would have liked till we introduced it up with Propeller and Thrive,” he stated.

RELATED CONTENT: Extra Individuals Want 6 Figures To Really feel Financially Safe