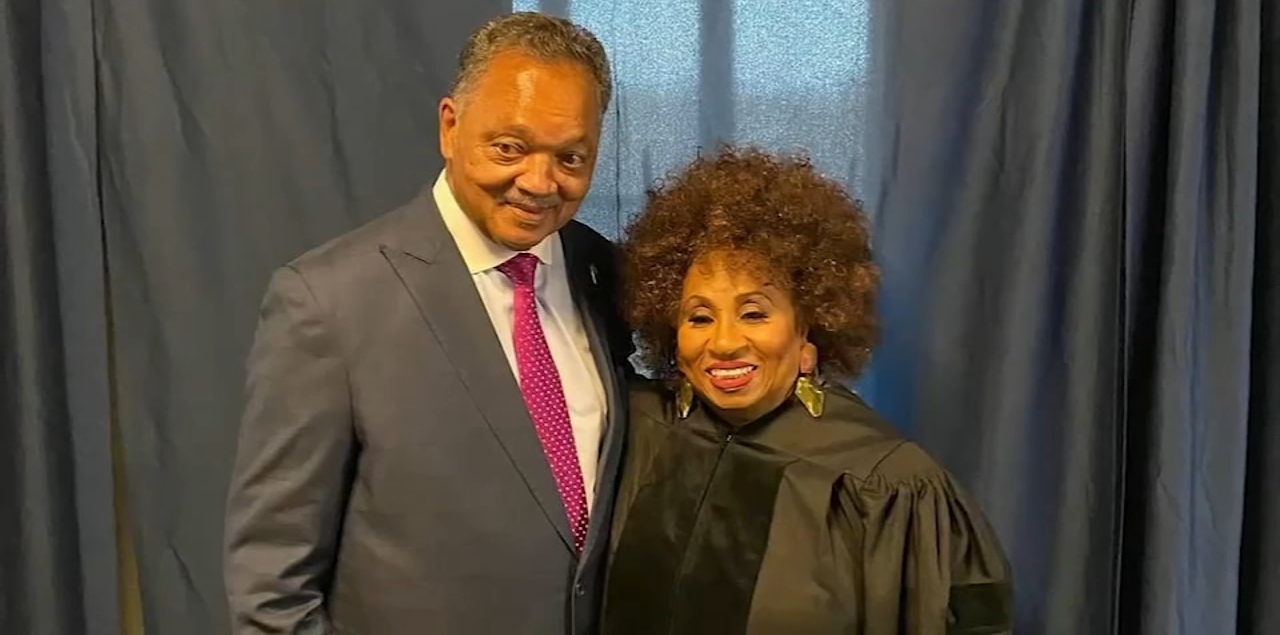

Lately, huge information broke about institutional efforts to extend Black and Latinx homeownership, and the Nationwide Affiliation of Actual Property Brokers is right here for it, in accordance with NAREB president Courtney Johnson Rose.

“The Nationwide Affiliation of Actual Property Brokers strongly helps the Federal Housing Finance Company’s proposed rule strengthening and codifying the equitable housing finance plans submitted by mortgage giants Fannie Mae and Freddie Mac and the company’s different measures addressing racial disparities in homeownership,” mentioned Johnson Rose. “These plans are one of many federal authorities’s handiest strategies of accelerating homeownership for households of colour and increasing their alternatives for reasonably priced rental housing.”

Johnson Rose factors out that underneath the proposed rule, Fannie’s and Freddie’s truthful lending and truthful housing features and equitable housing finance plans turn into statutory necessities. Additional, their operations will obtain clearer and extra applicable oversight, compliance and enforcement. These efforts are vital to fight the generational institutional roadblocks that stood between Black and Latinx wanna-be homebuyers and precise house purchases.

“These measures are obligatory to deal with many years of racially biased public insurance policies and personal practices aimed toward stopping Blacks from changing into owners. From rampant redlining to exclusion from Federal Housing Administration loans and advantages of the GI Invoice, the federal authorities isresponsible for the racial wealth hole in America. In research, Federal Reserve Banks acknowledge that racial wealth inequality is huge,” added Johnson Rose, who, like many, sees homeownership as vital for people and households to construct wealth.

“In 2019, the median wealth for White households was $188,200, in comparison with $24,100 for Black and $36,100 for Hispanic households. Black homeownership is a very powerful driver of Black wealth. However Black homeownership dropped almost 20% since 2008, and regardless of the contributions of the 1968 Honest Housing Act, over 50 years later, the racial homeownership hole has widened,” mentioned Johnson Rose.

And the numbers bear this out.

In 1960, 38% of Blacks owned houses, whereas White homeownership was 65%, a 27-point hole. Current information exhibits the hole approaching 30%.

In line with Johnson Rose, the FHFA has decided it’s time for the federal government to get severe about redressing the ache and struggling that the racist insurance policies triggered. She cites this yr’s FHFA plans which embrace extra highly effective provisions than the earlier plans created by the Authorities Sponsored Enterprises.

These plans embrace:

· Enhanced concentrate on guaranteeing current debtors obtain truthful loss mitigation assist and outcomes by way of monitoring and creating methods to shut gaps.

· Monetary capabilities teaching to construct credit score and financial savings.

· Help for regionally owned modular development amenities in communities of colour.

· Elevated utilization of Particular Function Credit score Packages to assist homeownership attainment and housing sustainability in underserved communities.

Although Johnson Rose is happy by the measures, she contends extra are wanted.

“FHFA have to be applauded for main a course of dedicated to alter, to equity, and to equality. The company has earned the assist of NAREB and different organizations that actually care about equitable communities. We stand with FHFA and a change permitting all People to benefit from the American Dream of homeownership.”