By Michayla Maxwell, Particular to the AFRO

and Layla Eason, AFRO Intern

Generational wealth is a subject that has develop into extra in style in recent times as a consequence of conversations concerning the wealth hole and the financial system.

Generational wealth is wealth that’s handed on from youngsters and grandchildren inside one household. The wealth in query might exist as money, actual property, companies or different tangible property an individual can personal.

Whether or not beginning a enterprise, having a number of jobs or going to school to earn a level, members of Era Z, or folks born between 1996 and 2012, are working towards constructing generational wealth for the long run. This month, the AFRO spoke with school college students who shared the that means of generational wealth and why it’s important.

Future Pridgen, a junior audio manufacturing main, feels generational wealth is extremely impactful and important.

“Generational wealth is important, particularly throughout the Black group, as a result of we aren’t allowed to progress the identical as [our White] counterparts. It’s crucial [that Black people] have that wealth constructed up so future generations can discover themselves in no matter profession they need and do what makes them pleased,” Pridgen stated.

Pridgen believes that generational wealth is extra than simply an accumulation of wealth however extra so about preventing programs that don’t all the time uplift African People. Rising up whereas the digital age developed, Gen Z is each conscious and uncovered to wealth disparity developments along with how they disproportionately have an effect on minorities. These developments have pushed a number of Gen Z minorities to work towards constructing one thing to maintain extra manageable life for his or her households sooner or later.

“I feel generational wealth helps minorities overcome obstacles which are set institutionally,” Pridgen shared.

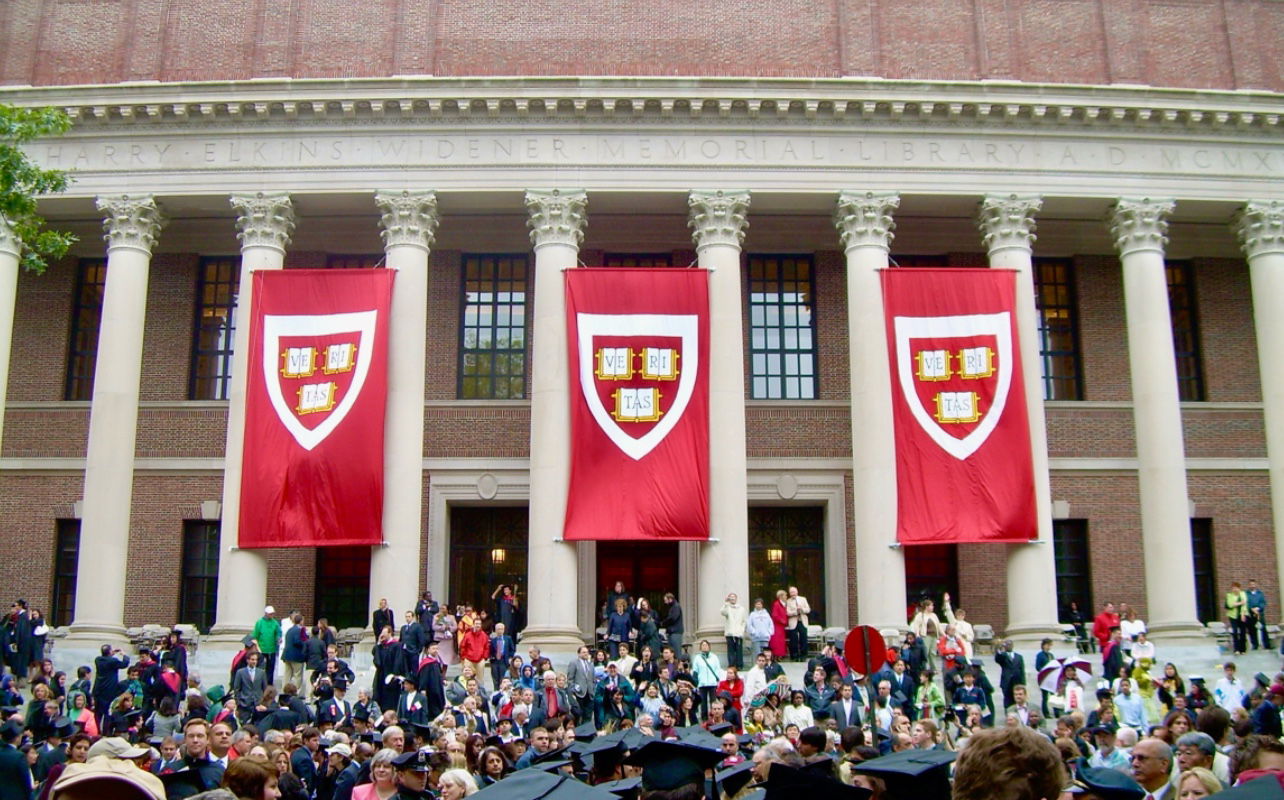

Training has usually proved itself a great tool when working to accumulate wealth and success.

“Generational wealth is helpful as a result of it permits Black folks to come up with the money for to get an schooling from wherever regardless of the pricey tuition, which was beforehand used to maintain Black folks out of those establishments,” Pridgen continued.

The college system is only one instance of a system with obstacles that Gen Z might overcome if extra minorities work towards generational wealth inside their households.

T’ana Wells, a junior TV and movie main at Howard, shared she additionally feels Gen Z should work towards generational wealth.

Wells thinks generational wealth is crucial as a result of “it permits many individuals to satisfy their want of offering for folks they care about. Rising up, my dad continually talked about how his household was filth poor. He labored onerous to make sure my sisters and I might go to school and never fear as a lot as he did.”

Wells agreed that having generational wealth can take the stress of being financially free off their youngsters and youthful relations.

“I plan on persevering with to work towards generational wealth in order that I cannot solely repay my father for what he has carried out for me, but additionally to make sure my sisters are taken care of once they develop into my age,” Properly acknowledged.

Different college students shifted the dialog to essentially the most sensible methods for Gen Z to begin the start of generational wealth of their households.

Brian Woodley, a junior in school, appears to be like at generational wealth as one thing that may uplift the Black group quite than simply particular person Black households.

“Generational wealth isn’t nearly cash; it’s a method to give the following era a head begin. For the Black group, that is essential to counter long-standing systemic obstacles. The trail to it includes extra than simply saving; it’s about investing correctly and planning long run,” Woodley stated.

Gen Z has already skilled a number of financial issues, together with scholar mortgage debt, unstable job markets and a price of residing that doesn’t sustain with wages. These experiences have pressured them to take steps to make sure they’re financially literate and conscious of what’s taking place within the financial system at present with issues like budgeting, investments and a number of strains of revenue.

Woodley continued to share that the federal government must do extra to assist extra communities develop into financially literate, which can give them the instruments to domesticate generational wealth.

“Monetary literacy is the toolkit it is advisable to construct and preserve that wealth. Universities and governments might higher present assets that talk on to the monetary challenges the Black group faces, from workshops to on-line instruments which are simple to entry and perceive,” Woodley acknowledged.

In accordance with the Monetary Model, Gen Z is the least loyal era with regards to permitting one financial institution to retailer their cash. The mistrust of Gen Z within the financial institution system places them at a drawback in figuring out the benefits of a financial institution and being extra financially literate general.

School scholar Marrion Parks expanded on why he thinks monetary literacy performs a major function in generational wealth.

“Simply from life experiences I’ve had, I’ve been capable of be round younger folks of colour that make remarks similar to I don’t belief banks or I maintain all my cash in money,” Parks acknowledged.

Gen Z is redefining their concepts of success whereas additionally working towards sustaining wealth surrounding their communities. Many college students a part of Gen Z are working onerous to construct generational wealth by means of pushing for widespread monetary literacy, entrepreneurship, and schooling.

“I feel each universities and governments might merely host classes the place we are able to get into contact with financial institution tellers or financial institution managers, to allow them to inform us how we are able to handle our cash or how you can put money into issues,” Parks shared. “We don’t have sufficient entry to monetary information because of the lack of the information being accessible.”

Devante Grenian, {an electrical} engineering main at College of Baltimore, stated schooling is essential.

“If I had the chance to know how you can financially plan all through school I feel I’d have extra money to place into financial savings to set me up for after commencement,” stated Grenian.“I’ve a greater understanding of how funds function, however I needed to determine it out by myself. There was no program to assist me or my friends.”

Increasingly more school college students like Grenian have been expressing their frustrations a couple of lack of monetary literacy once they graduate. As school college students first come to school and begin gaining extra independence, many take their new freedom and run with it. Many college students say they need they got the possibility to learn to correctly file taxes or steadiness a checking account whereas attending school and earlier than being pressured to be taught on their very own.

In school, college students are sometimes distracted from their monetary tasks and give attention to the enjoyable they’re having. At occasions this may result in harmful overspending, monetary irresponsibility and even debt.

“After I first bought to school I didn’t understand that each single factor would value me and I ended up blowing by means of the little cash I had,” stated Trevor Strigler, a multiplatform manufacturing main at Morgan State College (MSU). “I ultimately utilized for a bank card and didn’t actually perceive the way it labored which led to me damaging my credit score.”

College students even have completely different concepts of what wealth is and the way they’d preserve theirs. Whereas wealth is commonly outlined as an abundance of priceless possessions or cash, there are some who consider that wealth goes past that.

“To me wealth is having numerous cash and having freedom connected to it. In school I don’t suppose we’re given the talents to learn to achieve my model of wealth,” stated Femi Epps, a civil engineering main at MSU. “We go to lessons, examine, work half time jobs and must continually spend extra money than what we make. Wealth appears to be like completely different to everybody as a result of it’s a subjective subject–there is no such thing as a proper or incorrect to it.”

Layla Eason is an AFRO Intern from Morgan State College.