Whereas there’s at present a 30-day pause, President Donald Trump’s sweeping tariffs on Canada, China, and Mexico—America’s largest buying and selling companions—have already begun to rattle markets and shoppers.

The coverage, which imposes a 25% tax on all imports from Canada and Mexico and a ten% tariff on Chinese language items, is being framed as an aggressive transfer to curb migration, drug trafficking, and China’s function in fentanyl manufacturing. The U.S., Canada and Mexico have all agreed to pause deliberate tariffs for at the very least a month as negotiations over border safety proceed. China countered Trump’s tariffs on Chinese language merchandise with tariffs on choose U.S. imports. It’ll additionally launch an antitrust investigation into Google and different commerce measures.

The financial penalties are already being felt, with monetary markets in turmoil and on a regular basis Individuals bracing for value hikes in essential sectors comparable to gas, meals and vehicles.

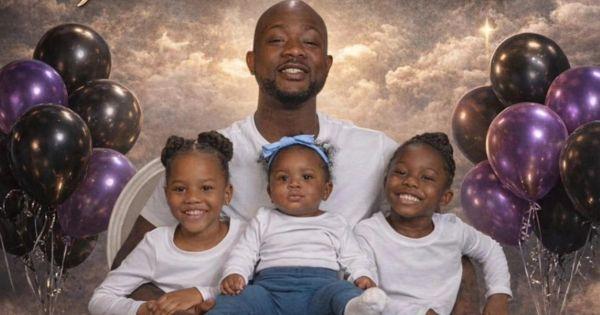

Monetary skilled Allan Boomer, a seasoned Wall Avenue veteran with greater than twenty years of expertise, mentioned the financial fallout in an interview with the Black Press. Boomer, who spent years advising institutional purchasers and managing multi-million-dollar funding portfolios at Goldman Sachs earlier than founding his agency Momentum Advisors, assessed the present monetary panorama.

“The market is bracing for an all-out commerce struggle,” Boomer stated, pointing to the deep financial ties between america and its neighboring buying and selling companions.

“Mexico and Canada every ship greater than 80 % of their exports to america, and retaliatory tariffs from these international locations may have extreme penalties,” he stated. “The last word loser on this state of affairs is the buyer. Finally, this ends in larger costs.”

Ache already being felt

Allan Boomer with Momentum Advisors, assessed the present monetary panorama.

“The market is bracing for an all-out commerce struggle,” Boomer stated, pointing to the deep financial ties between america and its neighboring buying and selling companions.

“Mexico and Canada every ship greater than 80% of their exports to america, and retaliatory tariffs from these international locations may have extreme penalties,” he stated. “The last word loser on this state of affairs is the buyer. Finally, this ends in larger costs.”

Ache already being felt

Houston writer and entrepreneur Kachelle Kelly is a kind of already feeling the ache of potential tariffs. In making ready for the discharge of her e book, Boss Mates Pray, she had the phrases all set, however went to pay and located the costs had soared.

“I negotiated bulk printing from Alibaba after going backwards and forwards with 4 distributors. Lastly discovered a candy spot and contacted to order and the worth was 30% extra. They’re making ready for tariffs. So I had to make use of KDP Amazon, which is way more costly. My older books, that are printed in America, get one thing from China so their costs went up. I’m shedding cash and should go a little bit of the worth to prospects,” Kelly stated.

Greater costs will damage small Black companies.

“The Defender is amongst these being damage by the tariffs,” stated Defender Community writer Sonny Messiah-Jiles. “Our printing prices instantly went up virtually 40% in anticipation of tariffs. Meaning we’ll should cut back manufacturing. There are a lot of Black and Brown companies that gained’t have the ability to survive a rise.”

Fuel costs within the Midwest have already risen by as a lot as 50 cents per gallon, as Canada and Mexico provide over 70% of crude oil imports to U.S. refineries. The auto trade can also be seeing quick results, with tariffs threatening so as to add as a lot as $3,000 to the worth of some autos.

In the meantime, grocery prices are anticipated to rise, as Mexico provides greater than 60% of America’s vegetable imports and practically half of the fruit and nut imports.

“We’re going to really feel this in Black and Brown communities,” Boomer stated. “Any neighborhood that spends cash as a excessive share of their wealth—whether or not Black, white, or Latino—goes to be hit arduous. However for Black and brown folks, who statistically spend essentially the most as a share of wealth, the impression goes to be extreme.”

Information v. fiction

Boomer questions the broader technique behind Trump’s commerce insurance policies, noting that whereas the administration touts these tariffs to strengthen the U.S. financial system, the truth could also be totally different.

“It is a president who stated he would strengthen america on the expense of our companions,” Boomer stated. “However what you’re seeing is that it’s actually at our personal expense. We import a bunch of issues—lumber, oil, tequila, avocados—and these tariffs have huge knock-on results in our financial system on a day-to-day foundation.”

Trump has positioned tariffs as a instrument to strain Canada and Mexico to make coverage concessions. “Trump is trying to leverage these tariffs for some type of win,” Boomer stated. “For instance, he’s stating that U.S. banks can’t function in Canada, and he’ll attempt to push for some small victories, however the query is, does anybody care?”

With markets in flux and fears of an financial downturn rising, Boomer suggested buyers to assume long-term. “You may’t make investments only for right now—it’s a must to make investments for tomorrow and for 10 years down the highway,” he stated. “Proper now, we’re in a extremely difficult political local weather, however within the subsequent two years, with the midterms, we would see a backing off of those excessive positions.” Boomer inspired buyers to think about the place they put their cash. “I’d be cautious of corporations which might be backing off their DEI (Range, Fairness, and Inclusion) initiatives,” he stated. “I simply don’t assume corporations that aren’t inclusive in hiring are going to do nicely in the long term.”

He additionally urged buyers to be aware of who’s managing their cash. “Am I investing in funds managed by various professionals or am I turning my cash over to non-diverse cash managers?” he requested. “These are issues folks ought to be taking note of on this local weather.” Nationwide City League President Marc Morial addressed broader considerations about Trump’s insurance policies on federal help, which may go away tens of millions of Individuals with out essential assist, together with meals help, training funding, small-business grants, and VA advantages for veterans.

“This administration’s reckless motion has already stirred widespread chaos and should trigger recessionary impacts comparable to elevated poverty, job losses, and financial stagnation,” Morial stated. “This isn’t a blueprint to ‘Make America Nice Once more.’ This isn’t placing ‘America First.’ That is leaving tens of millions of Individuals behind.”

NNPA contributed to this report.