With the passage of President Donald Trump’s One Large Stunning Invoice, many school freshmen are questioning what this implies by way of paying for his or her schooling.

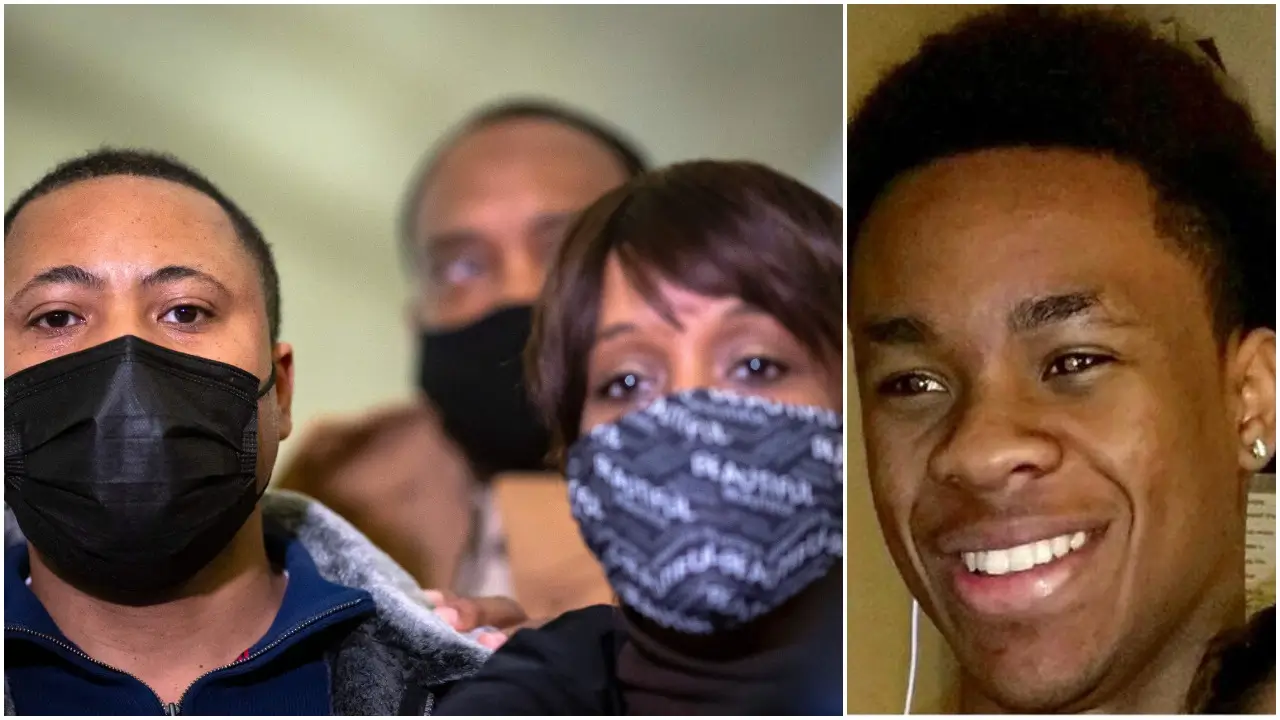

This contains Tamia Akers, an incoming pupil at Howard College.

Akers, who’s initially from Ohio, spent a few years overcoming private hurdles as a result of being within the foster care system till she was adopted at age 13. She then confronted extra challenges as the one Black pupil at her center and highschool.

“I felt like I used to be by no means heard or seen, or I wasn’t as sensible as the opposite children or I at all times needed to show myself in some completely different kind of method,” mentioned Akers to WUSA9.

As a senior, Akers determined that she needed to use to Howard College so she may very well be round younger Black college students pursuing a university schooling like herself. When she came upon the college had accepted her with a $20,000 scholarship, Akers’ want to be on the campus solely grew.

“I’m up all night time, and I can not sleep as a result of I’m like ready,” Akers informed the information outlet. “I’m like I promise that if I get in, I’m going. If you happen to give me an opportunity, I’m going.”

Sadly, President Trump’s One Large Stunning Invoice is predicted to have a number of adverse impacts on how she plans to get her schooling.

The One Large Stunning Invoice, signed into legislation earlier this 12 months by President Donald Trump, is a sweeping piece of laws that drastically reshapes the American social security internet, with large adjustments to the panorama of federal schooling assist. Whereas the administration touts it as a cost-saving measure, critics argue that it guts essential monetary protections for college kids, notably these from low-income and traditionally marginalized communities.

For instance, the brand new legislation places a restrict on how a lot mother and father can take out. The Mum or dad PLUS Loans shall be capped at $20,000 a 12 months, and most compensation plans, together with the Biden-era SAVE plan, shall be phased out.

These adjustments are anticipated to hit Black college students particularly laborious. Analysis persistently exhibits that Black debtors tackle extra pupil debt than their white friends and usually tend to battle with compensation. In keeping with the Training Knowledge Initiative, 86% of Black college students take out federal loans to attend school, in comparison with simply 59% of white college students.

4 years after commencement, Black debtors owe a mean of 188% greater than they borrowed, due largely to compounding curiosity and decrease post-grad earnings. The rollback of protections underneath Trump’s invoice might deepen these disparities, making it tougher for college kids like Akers to not solely attend school however to thrive after commencement.

However Akers is now planning to face this problem like all others in her life, with dedication.

“I believe I’m going to rise up and run at it as a result of I used to be begging for this opportunity. If you happen to give me the cash, I’ll apply. If you happen to let me in, I’ll go,” Akers mentioned. “If I gave up each time an impediment was thrown at me, I wouldn’t be the place I’m now.”

Watch the complete story about Akers’ expertise on WUSA‘s YouTube channel.