by Sharelle B. McNair

Might 22, 2025

Business consultants marvel if the SBA adjustments are actually about safer lending or only a huge try to wash away something that Joe Biden labored on.

Offers from the Small Enterprise Administration (SBA) secured by Black-owned companies are being terminated as new guidelines from the Trump administration are making it tougher for them to keep up, Forbes reviews.

To make SBA-backed loans safer for the federal government, a few of the new guidelines, efficient June 1, are stricter than they had been throughout President Donald Trump’s first time period. One new rule requires any enterprise receiving an SBA mortgage to be 100% –up from 51% — owned by U.S. residents, who should be everlasting residents for at the least six months.

The company introduced “SBA Eliminates Disastrous Biden-Period Underwriting Requirements,” labeling an “period of irresponsible lending.” Enterprise homeowners can count on tighter credit score checks, harder necessities on down funds, and fewer room to maneuver round debt service protection ratios.

Some guidelines have an effect on SBA’s in style 7(a) and 504 mortgage packages, providing government-backed financing for small companies. The 7(a) program permits loans of as much as $5 million for normal enterprise wants equivalent to working capital, gear, or buying an organization. The 504 program additionally goes as much as $5 million and is geared towards fastened belongings like actual property or massive equipment. Standing on its plan, Trump’s SBA claims the 7(a) program resulted in a “unfavorable money move of about $397 million” in 2024, its first loss in 13 years.

The transfer drastically differs from what was anticipated if former Vice President Kamala Harris secured the Oval Workplace. On the marketing campaign path, she promised to make issues simpler for Black enterprise homeowners to thrive with the “Alternative Agenda.” Based on CNBC, Harris needed to work with the SBA to offer Black entrepreneurs a million absolutely forgivable loans of as much as $20,000 to start out a enterprise.

Her marketing campaign deliberate to finance them by partnerships with “mission-driven lenders,” the SBA, and community-based banks.

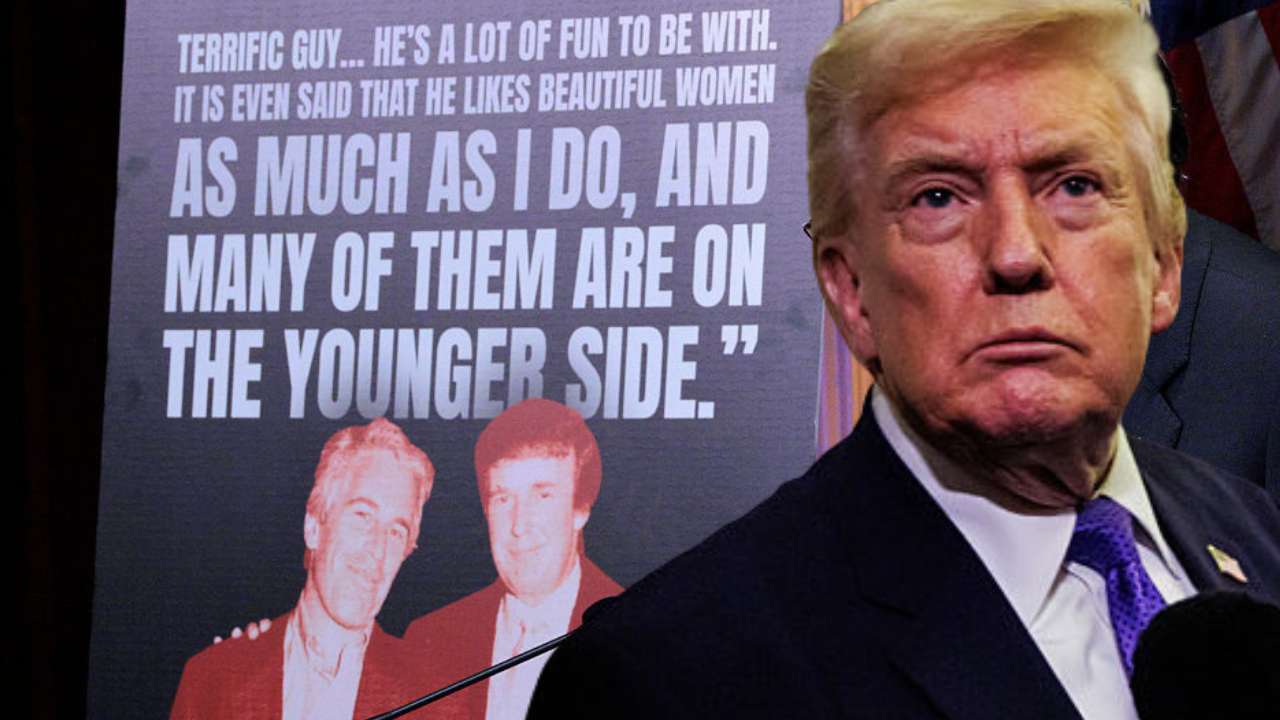

Nonetheless, since Trump is right here, trade consultants like Eric Pacifici of SMB Legislation Group, which advises small companies, marvel if the SBA adjustments are actually about safer lending or only a huge try to wash away something that may remind enterprise homeowners of a neater time, spearheaded by former President Joe Biden. It’s one-part signaling a return to tighter underwriting, but additionally reads as a considerably political reset slightly than a coherent coverage shift,’’ the founder stated.

Regardless, Pacifici feels the adjustments might be dangerous for the SBA, as stricter lending requirements and guidelines might squash good offers. As a substitute of accelerating the financial standing of enterprise homeowners who might help Trump, his administration is hurting them with pointless strikes.

RELATED CONTENT: SBA Extends Lending Licenses To Extra Nondepository Monetary Establishments To Enable Extra Federally Backed Loans