by BLACK ENTERPRISE Editors

October 18, 2025

Self-employed people, corresponding to small-business homeowners and unbiased contractors, are all the time in search of methods to scale back their tax invoice and higher handle healthcare prices. One usually neglected possibility amongst many new entrepreneurs is a well being financial savings account (HSA).

An HSA is a tax-advantaged account that permits you to pay for certified medical bills, corresponding to sure imaginative and prescient care and dental providers, with tax-free {dollars}. Not like a versatile spending account (FSA), which is sponsored and managed by an employer, you possibly can arrange and handle your personal HSA, even if you’re self-employed. GoodRx, a platform for medicine financial savings, shares essential concerns to remember earlier than opening an HSA by yourself.

Key takeaways:

You possibly can open a well being financial savings account (HSA) as a self-employed freelancer or enterprise proprietor in case you have a certified high-deductible well being plan.

An HSA will help self-employed people lower your expenses on out-of-pocket healthcare bills, corresponding to studying glasses and over-the-counter drugs.

Ensure you perceive HSA guidelines earlier than opening an account.

Can a self-employed individual have an HSA?

Sure. A self-employed particular person could also be eligible for an HSA if they’ve a certified high-deductible well being plan (HDHP). This contains Instacart buyers, freelance consultants, Uber drivers, and small-business homeowners. You don’t want to have an employer or a full-time job to be eligible for an HSA.

What are the necessities to open an HSA?

There are a number of guidelines that self-employed people ought to pay attention to earlier than opening an HSA. First, you need to have a certified HDHP. Your medical insurance plan should meet annual out-of-pocket expense limits and minimal deductible quantities. These plans sometimes include greater deductibles and decrease month-to-month premiums than different forms of protection.

In case your HDHP qualifies, you must be certain that you meet different necessities. Listed here are a number of of the HSA {qualifications} outlined by the Inside Income Service:

You don’t have any different well being protection besides sure disregarded protection, like dental and imaginative and prescient insurance coverage.

People enrolled in Medicare will not be allowed to contribute to an HSA.

Dependents on another person’s return might not take the deduction.

You’ve got HDHP protection on the primary day of the final month of the yr to satisfy the last-month rule. That is December 1 for a lot of self-employed people, whose insurance coverage plan yr usually begins on January 1.

Starting January 1, 2026, the eligibility guidelines for well being financial savings accounts (HSAs) will broaden. Beneath the One Huge Lovely Invoice Act (OBBBA), bronze and catastrophic Inexpensive Care Act (ACA) market plans can be reclassified as qualifying HDHPs. This variation will make it simpler for extra self-employed people to learn from the tax benefits of an HSA with out having to change to a standard HDHP.

How do you open an HSA?

When you meet the {qualifications} to open an HSA, you’ll have to discover a custodian or an administrator. This could be a financial institution, a credit score union, an insurance coverage firm, or a brokerage accredited by the IRS. A number of issues to think about when opening an account are:

What are the administration charges?

Is there a minimal greenback quantity to open the account?

Are there funding choices?

Is there a minimal money account steadiness wanted earlier than I can make investments my funds?

How a lot are the funding charges?

Will I get a debit card or must submit receipts for reimbursement?

As a sole proprietor, you’ll not have an employer contributing in your behalf or masking administrative charges. Do your analysis and ask the proper questions to make sure that the HSA meets your wants. You possibly can examine HSA suppliers on-line that can assist you make the very best resolution.

Sole proprietors vs. conventional staff

The HSA {qualifications} for a standard worker and a sole proprietor are the identical. However there could also be a distinction in making contributions to the account.

Historically, an worker tells their employer how a lot they want to contribute to their HSA. An employer can also contribute cash to reinforce worker advantages. The quantity contributed by an employer and worker should not exceed annual limits. The payroll division will deduct cash out of your paycheck to fund the HSA. That is known as a pretax contribution. Workers can contribute cash to their HSA earlier than their revenue is taxed. This could scale back your taxable revenue and prevent cash throughout tax time.

Being an entrepreneur can present extra freedom, nevertheless it additionally comes with extra duty. A sole proprietor has to arrange their very own HSA contributions. You possibly can switch cash out of your checking account to your HSA everytime you wish to. Many self-employed people make after-tax contributions to fund their HSA. This gives a possibility to say a deduction if you file your tax returns.

How a lot can I contribute to my HSA?

Your HSA contribution limits rely upon whether or not your well being plan has particular person or household protection. Different variables that have an effect on how a lot you possibly can contribute are:

Your age. If you’re 55 or older, you possibly can contribute an extra $1,000 to your account.

The date you turn out to be an eligible particular person. When you qualify to make HSA contributions by December 1, chances are you’ll be eligible to contribute the utmost quantity based mostly on the last-month rule.

The date you cease being an eligible particular person. You can’t make deductible contributions for any month by which you didn’t meet HSA necessities.

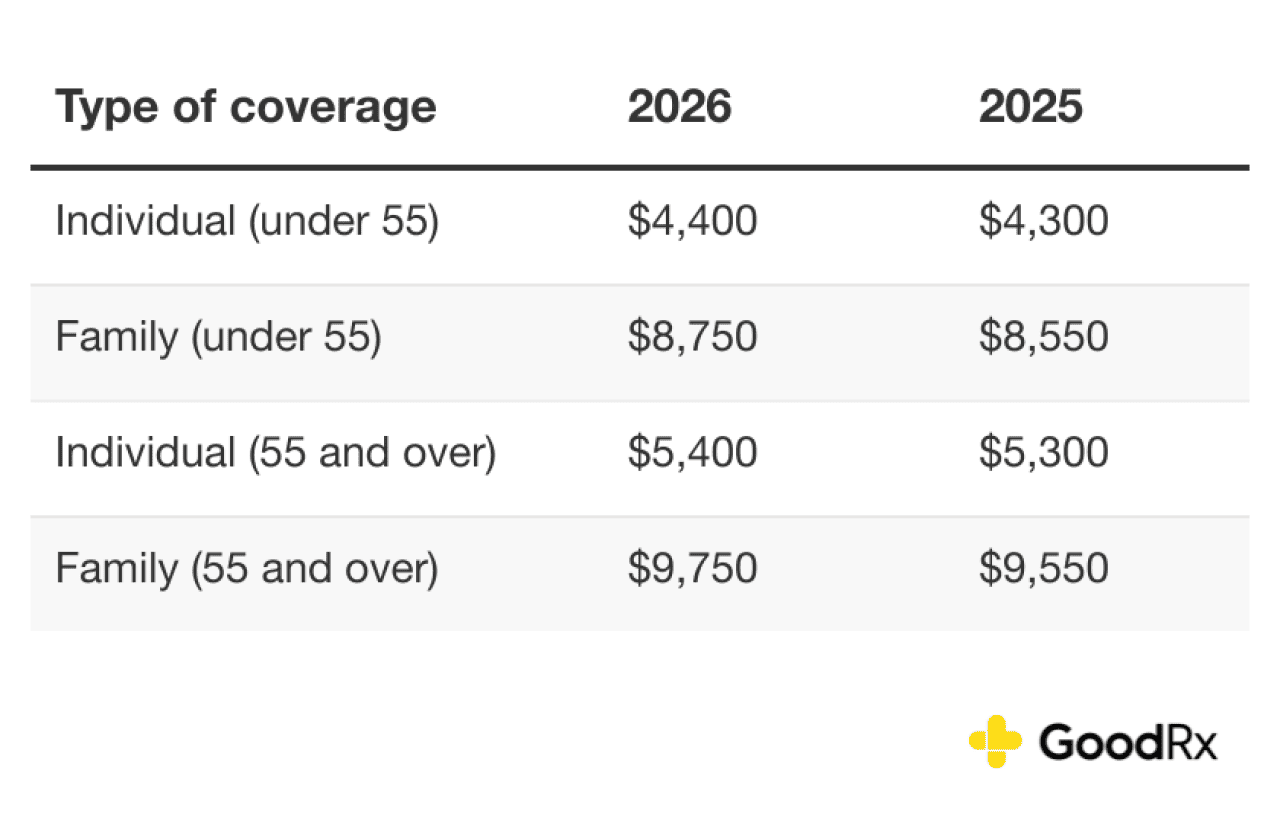

The contribution limits for 2025 are $4,300 for particular person HSA plans and $8,550 for a household plan. If you’re 55 or older on the finish of the tax yr, you’re eligible to make a catch-up contribution of $1,000. You’ve got till the tax deadline of the next yr to make your contribution. Meaning you possibly can contribute to a 2025 HSA till April 15, 2026, until the tax-filing deadline adjustments.

Listed here are the utmost HSA contribution limits for 2025 and 2026:

What are the advantages of getting a well being financial savings account should you’re self-employed?

An HSA is a monetary instrument that you simply personal, saves you cash, and gives tax incentives. Listed here are some extra advantages that may turn out to be useful for self-employed people:

The contributions keep in your account till you utilize them.

You aren’t required to contribute a minimal quantity.

You possibly can make investments the funds.

It’s possible you’ll use funds for certified medical bills.

Not like a versatile spending account, which requires you to make use of or lose the cash you’ve saved, your HSA {dollars} roll over yearly till you utilize them. You aren’t penalized if you don’t contribute to your account. There isn’t a minimal contribution annually, however there’s a cap on the quantity you possibly can contribute. You possibly can take advantage of your HSA contributions by investing your cash. As your cash grows, you’ll have more cash out there to fund future medical bills.

An HSA pairs nicely with HDHP protection as a result of it covers certified bills you incur earlier than assembly your deductible. This contains however is just not restricted to:

For a full listing of certified bills, try IRS Publication 502. The CARES Act added over-the-counter medicine and menstrual merchandise to the listing.

What are the downsides of an HSA?

HSA perks go solely thus far should you don’t know learn how to absolutely use them. Listed here are some doable downsides that you must contemplate, together with:

Insurance coverage plan necessities: Solely people enrolled in a certified HDHP can contribute to an HSA. With this kind of plan, you’ll have to pay on your healthcare bills out of pocket till you meet your deductible, which could be 1000’s of {dollars}.

Annual contribution limits: There’s a cap on how a lot you possibly can contribute to an HSA yearly. When you contribute past the bounds, you would face a 6% extra contribution penalty.

Spending restrictions: Your HSA is used to pay for certified medical bills. When you spend your HSA {dollars} on non-qualified bills, you’ll owe revenue tax on the distribution. Additionally, you will face a penalty if you’re beneath 65.

Funding dangers: When you make investments the funds in your HSA, your funding may lose worth if market circumstances will not be favorable.

Account charges: Relying in your HSA supplier, you might have to pay charges for providers corresponding to account upkeep, investments, transactions, and paper statements.

Ineligibility with Medicare: You possibly can not contribute to an HSA after you enroll in Medicare. However you’ll nonetheless have the ability to use the funds in your account to pay for certified medical bills.

The underside line

Self-employed people can contribute cash to an HSA and use the funds to pay for certified medical bills. If you wish to open an account, ensure you have a qualifying well being plan and perceive HSA guidelines. You also needs to inquire concerning the account necessities to make sure you’re not confronted with any sudden charges. An HSA could be very useful to self-employed people, nevertheless it’s essential to do your analysis to find out if it’s the very best account on your wants.

This story was produced by GoodRx and reviewed and distributed by Stacker.

RELATED CONTENT: Venus Williams Is Profitable In The Identify Of Well being Insurance coverage