By Ali SwensonThe Related Press

NEW YORK (AP) — For one Wisconsin couple, the lack of government-sponsored well being subsidies subsequent yr means selecting a lower-quality insurance coverage plan with a better deductible. For a Michigan household, it means going with out insurance coverage altogether.

For a single mother in Nevada, the spiking prices imply fewer Christmas presents this yr. She is stretching her price range already whereas she waits to see if Congress will act.

Lower than three weeks stay till the expiration of COVID-era enhanced tax credit which have helped tens of millions of Individuals pay their month-to-month charges for Inexpensive Care Act protection for the previous 4 years.

The Senate on Dec. 11 rejected two proposals to deal with the issue and an rising well being care package deal from Home Republicans doesn’t embody an extension, all however guaranteeing that many Individuals will see a lot increased insurance coverage prices in 2026.

Listed below are a couple of of their tales.

From a gold plan to a bronze plan, a pair spends extra on much less

Chad Bruns comes from a household of savers. That got here in helpful when the 58-year-old navy veteran needed to go away his firefighting profession early due to arm and again accidents he incurred on the job.

He and his spouse, Kelley, 60, each retirees, lower their very own firewood to cut back their electrical energy prices of their house in Sawyer County, Wisc. They not often eat out and rarely purchase groceries except they’re on sale.

However to the extent that they’ve all the time been frugal, they are going to be pressured to be much more so now, Bruns stated. That’s as a result of their protection below the well being legislation enacted below former President Barack Obama is getting costlier -– and for worse protection.

This yr, the Brunses had been paying $2 per 30 days for a top-tier gold-level plan with lower than a $4,000 deductible. Their earnings was low sufficient to assist them qualify for lots of economic help.

However in 2026, that very same plan is rising to an unattainable $1,600 per 30 days, forcing them to downgrade to a bronze plan with a $15,000 deductible.

Kelley Bruns stated she is anxious that if one thing occurs to their well being within the subsequent yr, they may go bankrupt. Whereas their month-to-month charges are low at about $25, their new out-of-pocket most at $21,000 quantities to just about half their joint earnings.

“We’ve to hope that we don’t must have surgical procedure or don’t must have some medical process carried out that we’re not conscious of,” she stated. “It will be very devastating.”

Household dealing with increased prices prepares to go with out insurance coverage

Dave Roof’s household of 4 has been on ACA insurance coverage because the program began in 2014. Again then, the accessibility of insurance coverage on {the marketplace} helped him really feel comfy taking the leap to start out a small music manufacturing and efficiency firm in his hometown of Grand Blanc, Mich. His spouse, Kristin, can be self-employed as a prime vendor on Etsy.

The protection has labored for them thus far, even when emergencies come up, similar to an ATV accident their 21-year-old daughter had final yr.

However now, with the expiration of subsidies that stored their premiums down, the 53-year-old Roof stated their $500 per 30 days insurance coverage plan is leaping to not less than $700 a month, together with spiking deductibles and out-of-pocket prices.

With their joint earnings of about $75,000 a yr, that improve just isn’t manageable, he stated. So, they’re planning to go with out medical health insurance subsequent yr, paying money for prescriptions, checkups and the rest that arises.

Roof stated his household is already residing cheaply and has not taken a trip collectively since 2021. As it’s, they don’t get monetary savings or add it to their retirement accounts. So although forgoing insurance coverage is demanding, it’s what they need to do.

“The concern and nervousness that it’s going to placed on my spouse and I is de facto arduous to measure,” Roof stated. “However we are able to’t pay for what we are able to’t pay for.”

Single mother strains her January price range in hopes Congress acts quickly

Should you ask Katelin Provost, the American center class has gone from experiencing a squeeze to a “full suffocation.”

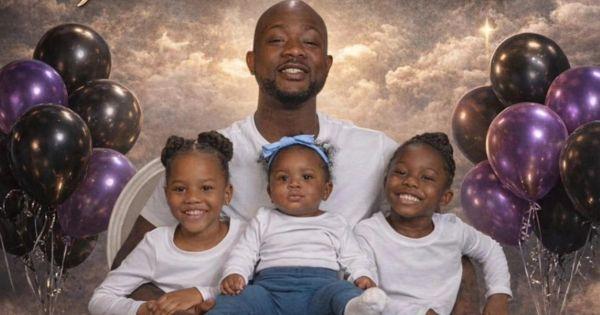

The 37-year-old social employee in Henderson, Nev., counts herself in that class. As a single mother, she already retains a decent price range to cowl housing, groceries and day look after her 4-year-old daughter.

Subsequent yr, that’s going to be even more durable.

The month-to-month price on her plan goes up from $85 to just about $750. She determined she goes to pay that increased value for January and reevaluate afterward, relying on whether or not lawmakers lengthen the subsidies, which as of now seems unlikely. She hopes they may.

If Congress doesn’t act, she is going to drop herself off the medical health insurance and hold it just for her daughter as a result of she can’t afford the upper price for the 2 of them over the long run.

The pressure of 1 month alone is sufficient to have an effect.

“I’m going to must reprioritize the subsequent couple of months to rebalance that price range,” Provost stated. “Christmas might be a lot smaller.”