Within the small, picturesque city of Evansville, Indiana, issues are abuzz at One Foremost Avenue. It’s the headquarters of Outdated Nationwide Financial institution, the identical location the place the monetary establishment first opened its doorways in 1834.

Outdated Nationwide Financial institution, the biggest monetary providers financial institution holding firm headquartered in Indiana and one of many high 100 banking corporations within the U.S., has been generally known as an old school financial institution with a well timed motto: put folks first. The group wakes up each morning fascinated with its purchasers and communities: tips on how to help them higher and take care of each other, from the shoppers who stroll by way of its doorways to its staff.

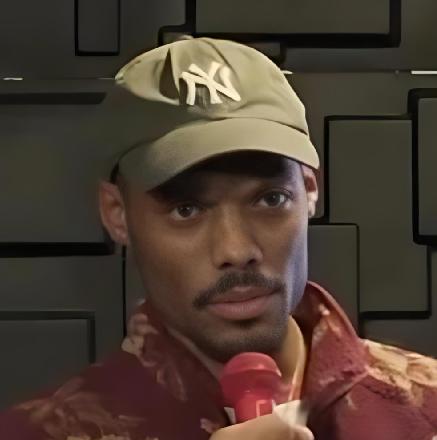

“We’re occurring 190 years of creating nice relationships with our communities and our stakeholders and constructing a model that emphasizes togetherness,” declares Roland Shelton, Outdated Nationwide Financial institution’s chief strategic enterprise partnership officer who focuses on offering capital to underserved communities and creating financial alternatives. “The corporate continues to emphasize ‘folks caring for our folks’ and dealing collectively as a group.”

That was proven as quickly as EBONY touched right down to interview Shelton, Outdated Nationwide Financial institution’s first African American C-suite govt. A congregation of Outdated Nationwide Financial institution staff and their alliances embraced our group, from assembly with new Black c-suite executives like Corliss Garner, chief DE&I officer, SVP, and board of director member Derrick Stewart, an govt with the YMCA retirement fund, to sitting down for breakfast and breaking bread with the financial institution’s chairperson and CEO Jim Ryan.

With Shelton main the cost, Outdated Nationwide Financial institution has been reaching out to a various clientele and impacting communities of coloration over time.

“Whereas we’re 190 years previous, we have remodeled ourselves in the previous couple of years, and Roland has been an enormous a part of that,” Ryan shared with EBONY.

“We’d have the alternatives to make loans, notably within the minority enterprise neighborhood, they usually would not match the standard mould of a mortgage software. I needed somebody we might put answerable for operating a particular mortgage program centered on underserved communities and populations and make it simpler for them to do enterprise with us. Roland has put a handful of leaders in place to execute this throughout our footprint … He has all the time been an outstanding cultural ambassador for the corporate.”

On this EBONY unique with Shelton, the chief explains a number of of the financial institution’s greatest initiatives to assist Black Individuals and different BIPOC populations discover methods to construct generational wealth in 2024 and past.

EBONY: Many thrilling issues are taking place at Outdated Nationwide Financial institution in 2024. Let’s begin with the MDI, an enormous ardour venture of yours: constructing the primary Black-owned financial institution in Indianapolis.

Roland Shelton: Minority depository institutes—MDIs—supply a possibility to work with underserved communities and serve the folks by way of an establishment run by those that appear to be themselves. The Workplace of the Comptroller of the Foreign money (which safeguards a various banking system that makes monetary providers accessible to underserved shoppers and areas) has inspired banks to get extra concerned with MDIs, so we determined to be main traders. We began with the CEO Council, a gaggle of primarily minority rising leaders engaged on the venture for a yr and a half, who realized tips on how to begin a financial institution and supply the platform for Rafael Sanchez, our chief impression officer and market president in Indianapolis, to maneuver ahead with the venture. I am excited concerning the impression it will have in Indianapolis. And we’ll ultimately take a look at enlargement in different markets.

Beginning the MDI will result in higher monetary alternatives in that neighborhood. Outdated Nationwide Financial institution additionally gives a web-based program to assist folks throughout the nation enhance their monetary literacy.

Ben Joergens, our monetary empowerment program director, leads that effort, which, at each degree, educates you in your monetary skills and areas like saving and understanding the banking system. We craft the entire instructional course of round financing and serving to people, even these about to exit incarceration, who will now be beginning their lives over with an understanding of funds. It is an awesome platform for us, and it continues to develop.

Why is it so vital for the Black neighborhood to be financially literate?

Our neighborhood has struggled with understanding credit score and the capital side of saving. Traditionally, it’s a pattern that has hampered the neighborhood. Understanding monetary literacy—your family revenue, financial savings and investing—can assist create the generational wealth wanted to alter somebody’s life and the result of their household.

Do you will have any recommendations on tips on how to begin a profitable monetary plan?

Management your bills and do not overextend. It is good to need to get sure gadgets, but when they do not suit your monetary focus, do not put money into one thing that can create nice debt. Then, construct off that. It doesn’t occur in a single day. It’s a really disciplined course of, and it takes time to construct that generational wealth.

Constructing generational wealth can be about entrepreneurship. How is Outdated Nationwide Financial institution serving to Black entrepreneurs succeed on that entrance?

We’ve created the empowerment small enterprise mortgage program, with loans as much as $5 million. We’ve a credit score group that may assessment these alternatives. Financial success and generational wealth begin with creating jobs and employment alternatives for folks and dealing to construct generational funding alternatives and the community they want. The empowerment mortgage program has generated greater than $30 million in loans in its first yr, offering entry to capital to girls and minority companies. It is great to see the adjustments it makes in a corporation, its folks and their communities.

Outdated Nationwide Financial institution has expanded its provider range program. Why is that this initiative so vital, and the way profitable has it been?

Working with numerous suppliers, that’s girls and minority companies with 51% or extra possession, and figuring out that creates job alternatives, partnerships and nice providers for the financial institution is superb for Outdated Nationwide Financial institution. We’ve $50 billion in belongings and that platform has grown as a result of our footprint has grown. To see a woman- or minority-owned enterprise profit from working with us, how we assist these companies get the certifications they want by way of a program beneath the management of Kawn Watters, it’s all of us working collectively to drive financial energy, empowerment and neighborhood. Proper now, we’re succeeding in our eligible spend aim considerably.

Outdated Nationwide Financial institution has intensive outreach to its communities, however it’s additionally constructing leaders of coloration inside the financial institution by way of its C-suite coaching program.

Jim Ryan talked to me about making a coaching program centered on minority mid-level executives getting experiences and improvement that may assist them develop and stretch. And the CEO Council was created. Bringing in executives from all strains of enterprise, involving them in venture work, coaching and improvement, and letting them expertise mentorship from the chief management group and perceive the expectations is phenomenal. I have been to different organizations, and I’ve by no means seen something fairly prefer it by way of coaching and getting the publicity it’s worthwhile to put together for C-suite alternatives.

What was the profession path that led you to your C-suite place?

It was unorthodox. I began in company gross sales with Campbell’s Soup Firm, labored a short time with Coca-Cola, branched off into manufacturing with Philip Morris after which spent a very long time with Common Motors. I additionally labored within the higher-ed area and fundraising. It wasn’t a transparent path to banking. I got here right here as the chief enterprise improvement officer, and I did Outdated Nationwide Financial institution’s management program a number of years in the past. I inform folks on a regular basis that there are transferable expertise in management, irrespective of the place you are at. You do not have to remain in a single place to have the ability to profit an organization. I used to be very blessed to be in the best place and have the best talent set.

You’re the first African American in a C-suite place at Outdated Nationwide Financial institution. How did it really feel to earn that visibility?

I by no means thought it will occur in my profession. And when it occurred right here, reporting to our chairperson and CEO and dealing with a dynamic group of executives on the high of their sport within the discipline, I used to be blown away. My mom was nonetheless alive on the time, and she or he was so extraordinarily proud. To be the primary is nice and really humbling. There’s additionally accountability and expectations round that. I do know that others have helped me by way of the method. I’ve had nice mentors and sponsors. It is now my duty to try this. It is vital to succeed in again and assist convey folks to the subsequent degree. It’s an awesome honor and an awesome duty.

What are some management qualities a C-suite, and only a nice human being, ought to have?

Be genuine: be who you might be. Perceive the extent of accountability and duty in your function. Perceive that you just characterize not solely the work that you just’re doing however the firm, your shareholders, the neighborhood and others who’re keen and need to climb of their careers. They’re watching as effectively. You want ethics, integrity and suppleness. Perceive the tradition you’re in, the variations and folks, and continue to grow your community. Outdated Nationwide Financial institution has been a life-long journey, a possibility to be my greatest with the perfect, and a platform to create unimaginable alternatives for our neighborhood and folks. It is a blessing to make use of my skills and expertise and be supportive. Day-after-day, I get up considering that is unbelievable. God has supplied this chance. And it is my duty to do the perfect job every single day.