It’s not nearly whether or not you should buy a automobile or get permitted for an condo. It’s about freedom. Choices. The flexibility to say sure to alternatives with out being held again by a quantity most of us have been by no means taught to grasp.

For a lot of younger Black adults, that quantity — your credit score rating — can silently form your future earlier than you even get an opportunity to construct it.

And the chances aren’t in our favor. Analysis from the City Institute reveals that 25 to 29-year-olds in majority Black communities have a median credit score rating of 582, which is beneath the subprime stage of 600. That’s greater than 100 factors decrease than younger adults in majority white neighborhoods. Much more alarming, practically a 3rd of younger folks in Black communities noticed their credit score scores decline as they received older, as a substitute of enhancing.

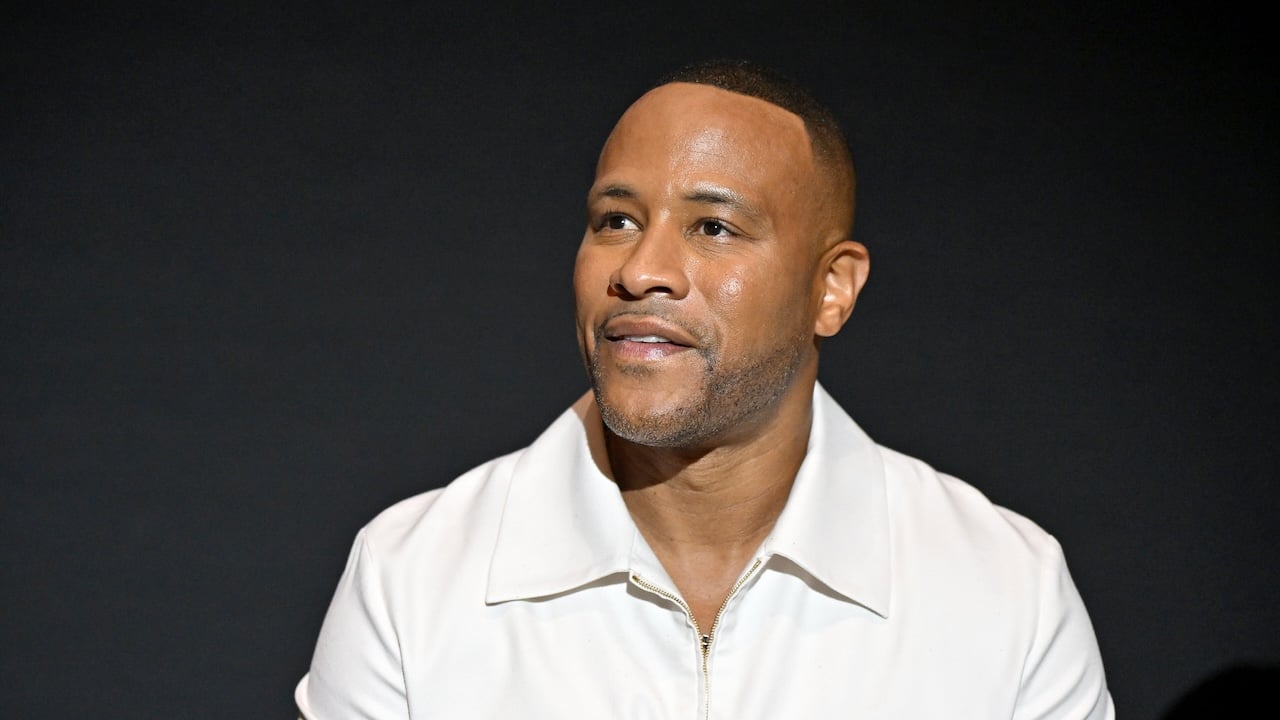

“Your credit score rating is likely one of the first methods lenders and even landlords determine how reliable you might be with cash,” stated Dr. Johnny O’Connor, Board Chair for Youth Applications of the Texas Black Expo. “It might influence the whole lot from getting permitted for an condo to the rate of interest in your automobile mortgage.”

O’Connor says younger adults ought to perceive the fundamentals.

What’s a credit score rating?

A credit score rating is a quantity starting from 300 to 850 that displays your creditworthiness. It’s calculated primarily based in your fee historical past, the quantity of debt you owe (particularly in comparison with your credit score limits), the size of your credit score historical past, the kinds of credit score you employ and the way typically you apply for brand new credit score.

Many younger folks consider they will wait till they’re older to care about credit score. However Dr. O’Connor warns in opposition to that mindset. “A low credit score rating may imply you pay double and even triple for a similar home over time resulting from greater rates of interest,” he stated. “Even in the event you’re not shopping for a home proper now, poor credit score can price you extra in the long term.”

Key components that form your rating

Credit score scores are made up of a number of elements, however two stand out, particularly for newcomers:

Credit score Utilization: That is how a lot of your obtainable credit score you’re utilizing. “By no means go over 30%,” stated O’Connor. “In case your bank card has a $10,000 restrict, maintain your stability below $3,000.”

Cost Historical past: At all times pay your payments on time. Even in the event you can’t pay the complete stability, paying at the least the minimal helps construct a robust historical past of reliability.

Credit score Historical past: Credit score scoring corporations assess credit score age, or “depth of credit score,” to find out an individual’s credit score administration skill, which is essential for future mortgage selections.

Mixture of credit score: Credit score scoring methods favor a mixture of installment debt and revolving accounts, indicating that managing a number of money owed and credit score varieties can enhance credit score scores.

Opening a brand new line of credit score: Arduous inquiries in your credit score may end up in just a few factors being deducted out of your rating for every software. To take care of a wholesome credit score rating, it’s really helpful to house out new credit score purposes by at the least six months.

The way to plan strategically

Managing cash and constructing credit score is a strategic balancing act—one they’ve typically had to determine on their very own. Maisha Walker, a school graduate with an accounting diploma, is amongst a rising variety of younger adults taking private finance into their very own arms within the absence of early monetary schooling.

“Accounting simply made sense for me,” stated Walker, who graduated in late 2022 and now works within the business. “I’ve all the time loved math, had a thoughts for enterprise and noticed it as a secure profession selection.”

However even with a numbers-driven mindset, Walker admits the credit score system has been one of many extra opaque monetary ideas to understand.

“I believe essentially the most complicated factor is how credit score scores can fluctuate even if you’re doing the whole lot proper,” she stated. “I repay my balances each single month and nonetheless I’ll see my rating dip a bit and I don’t actually perceive why.”

Walker’s monetary journey grew to become extra intentional throughout her senior 12 months of faculty, when the looming actuality of maturity set in, excited about shopping for a automobile, renting an condo and constructing her credit score. That’s when she received her first pupil bank card, charging solely small bills like gasoline and meals and ensuring to pay the stability in full each month.

“I knew that constructing a superb credit score rating was necessary for my future,” she defined.

At present, Walker considers herself financially accountable. She tracks each greenback she spends utilizing a self-made Excel spreadsheet. Every month, she calculates her financial savings and evaluates the place her cash goes. She offers herself strict budgets and is intentional about what she chooses to splurge on.

“Saving has been one of many greatest classes,” she stated. “There are all the time surprising bills that come up, so it’s necessary to have a cushion for these moments.”

Regardless of her background in accounting, she believes monetary literacy—particularly round credit score—must be taught earlier in life. “Credit score scores must be extra easy,” she stated. “Numerous us are nonetheless confused by the way it works as a result of we have been by no means taught.”

The way to construct and preserve good credit score?

O’Connor affords these foundational ideas:

Begin small. A pupil bank card or secured card is usually a good entry level, however provided that you employ it properly. Make small purchases and pay them off in full each month.

Pay on time. Each time. Cost historical past makes up a giant chunk of your rating. One late fee can stick round for years.

Maintain your balances low. Attempt to use lower than 30% of your credit score restrict at any time, even decrease is healthier.

Keep away from pointless new credit score. Each time you apply for credit score, your rating takes successful. Don’t apply for a number of playing cards or loans without delay.

Test your credit score report. Everyone seems to be entitled to a free credit score report from every of the three credit score bureaus yearly at AnnualCreditReport.com. Use that to verify the whole lot in your report is correct.