OPINION: The Wealth Wednesday’s Actual Property Membership began by Energy 105.1’s Angela Yee, monetary skilled Stacey Tisdale, and actual property investor Sayam Ibrahim, is taking intention on the “Black Tax” – the upper charges and charges charged to individuals of shade for actual property. Contributing author Logan Gamble explains how “Black Tax” impacts us.

Think about a younger couple, keen to start out a household, lastly saving sufficient for a down cost.

They discover their dream residence, solely to be hit with a better rate of interest than their white counterparts—merely due to the colour of their pores and skin.

This so-called “Black tax” isn’t a literal tax, however relatively the cumulative impact of discriminatory practices that create vital monetary disadvantages for Black and Hispanic people in search of to construct wealth by means of actual property.

And, it snakes its manner all through your entire banking and homebuying course of. These are among the methods which the “Black Tax” manifests within the course of:

Increased Mortgage Charges

Black and Hispanic debtors usually face larger rates of interest than white debtors with related credit score profiles. This isn’t merely a matter of particular person creditworthiness.

Historic discrimination in lending, restricted entry to credit-building alternatives, and biases embedded inside credit score scoring fashions contribute to this disparity.

Even when controlling for earnings and debt-to-income ratio, research have proven that Black debtors are nonetheless extra prone to be provided subprime loans with larger rates of interest.

Over a 30-year mortgage, this seemingly small distinction can translate to tens of 1000’s of {dollars} in additional curiosity paid, considerably hindering wealth accumulation.

Increased Charges

The upfront prices of shopping for a house—origination charges, appraisal charges, and shutting prices—can even disproportionately affect debtors of shade.

Origination charges, charged by lenders for processing the mortgage, could be larger for Black and Hispanic debtors.

Whereas appraisal charges themselves is perhaps related, the potential for appraisal bias (mentioned under) can not directly result in larger prices if a number of value determinations are wanted to problem a low valuation.

Closing prices, together with title insurance coverage and escrow charges, can even fluctuate based mostly on location and lending practices, additional compounding the monetary burden.

Increased Insurance coverage Premiums

Owners in predominantly Black neighborhoods usually face inflated owners insurance coverage premiums.

This can be a direct consequence of historic redlining, a discriminatory apply the place lenders and insurers actually drew pink traces round predominantly Black neighborhoods on maps, marking them as “high-risk” and denying them providers or charging exorbitant charges.

Whereas redlining is now unlawful, its legacy persists in outdated threat evaluation fashions that proceed to affiliate predominantly Black neighborhoods with larger threat, even when knowledge doesn’t help this notion.

Decrease Value determinations

Maybe one of the insidious elements of the “Black tax” is appraisal bias.

Research have constantly proven that properties in predominantly Black neighborhoods are sometimes appraised at decrease values than comparable properties in white neighborhoods.

This undervaluation instantly limits the quantity of fairness owners can construct, making it tougher to entry residence fairness loans for issues like schooling or beginning a enterprise, refinance for higher charges, or promote their properties for a good value.

This perpetuates the wealth hole and makes it harder for Black households to construct generational wealth.

This isn’t nearly statistics; it’s about actual individuals, actual households, and actual goals being deferred.

However whereas we proceed to combat for systemic change, we consider in empowering ourselves now.

Constructing Wealth Collectively: The Energy of Collective Motion

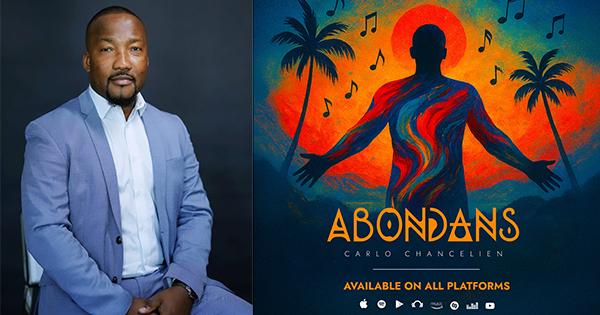

The Wealth Wednesdays Actual Property Membership is a group constructed on the assumption that collective motion can overcome systemic limitations. We’re not only a membership; we’re a motion. Based by Radio Corridor of Famer, host of Manner Up With Angela Yee, and co-host of the Wealth Wednesdays monetary empowerment platform, together with award-winning monetary journalist, Stacey Tisdale, and actual property educator/investor, Sayam Ibrahim, the membership has a objective of empowering members to collectively purchase $100 million {dollars} in actual property by the tip of 2025.

By weekly conferences and programs, the membership holds classes about every little thing from navigating the homebuying course of to figuring out funding alternatives. Nonetheless, the group’s largest objective is to attach members with a supportive group of like-minded people, sharing information, sources, and encouragement.

The “Black tax” is an actual impediment, nevertheless it doesn’t must outline your monetary future.

By becoming a member of forces and leveraging collective information and sources, we are able to overcome these challenges and construct the wealth we deserve.