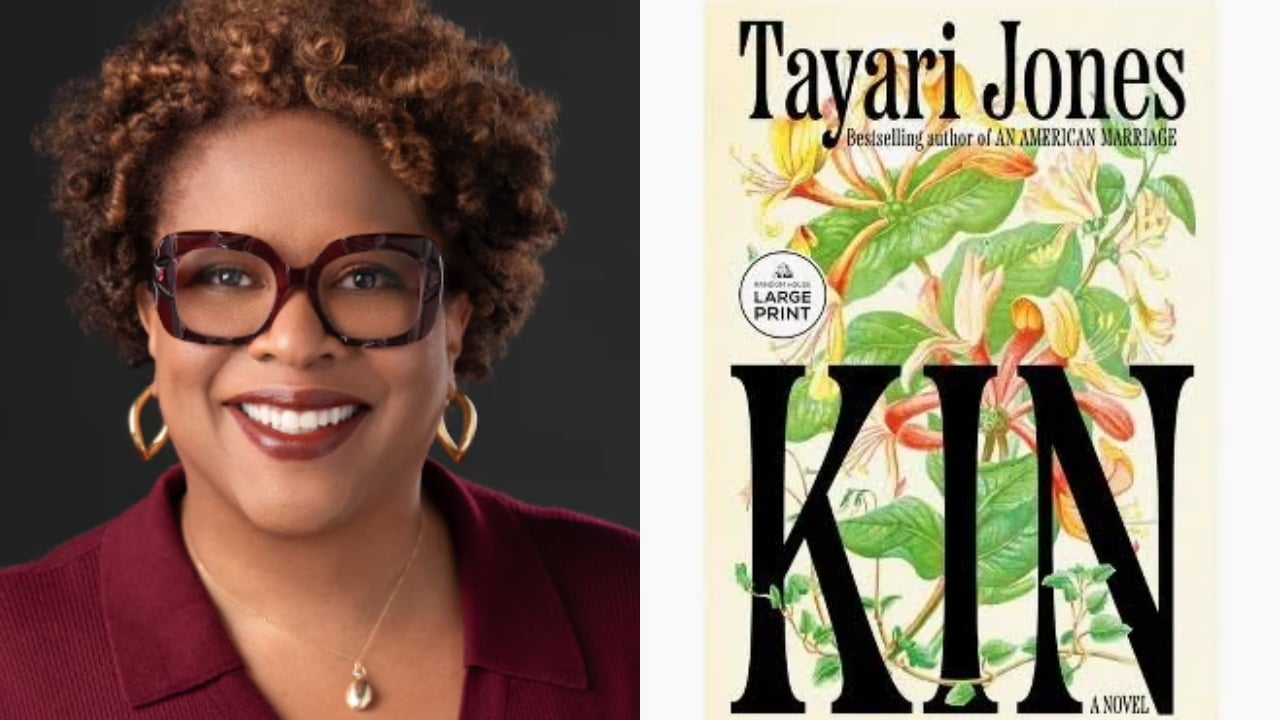

Constructing a model for your self and your organization can take some work, and Kendra Bracken-Ferguson has the abilities and experience that can assist you elevate to the following stage. Because the founder and CEO of BrainTrust, she gives social media, influencer advertising, and improvement for corporations. Bracken-Ferguson has seen what it takes to have a profitable enterprise as considered one of 100 Black ladies to lift over $1 million in funding for her first firm. Now, she’s serving to Black magnificence and wellness entrepreneurs construct and develop their companies.

Bracken-Ferguson spoke with rolling out about BrainTrust and what issues to search for in an investor.

How did you create your organization?

I began my first firm, Digital Model Architects, in 2010, and we have been one of many first companies to handle bloggers. We ended up elevating capital, and I turned a part of the primary group of 200 Black ladies to lift greater than one million {dollars}. I had this imaginative and prescient and notion of being within the boardroom, calling my traders, and having these nice conversations, [but] that’s not fairly what occurred. By means of that have, I realized that it’s one factor to determine an investor, however you must watch out who your traders are. I needed to create alternatives to have the traders I want I had, who have been placing within the capital [and with whom] we might speak about enterprise sustainability and generational wealth. By creating the BrainTrust Founder Studio, 1697503726 the most important membership-based platform for Black magnificence and wellness founders, we had a possibility to [look] at capital otherwise. So, we created the BrainTrust Fund to additional help and spend money on these Black founders by way of the studio.

What are some issues to think about when on the lookout for an investor?

Not all enterprise funding is for each firm. I all the time inform founders to have a look at differentiated sources of funding, from grants to small enterprise loans to pitch competitions, as a result of, in enterprise, you must know that we’re on the lookout for a return, resembling a three- to five-time return, and typically better in different classes. You even have to grasp that your traders need info, so ship them quarterly studies. We all the time say excellent news can wait, however dangerous information we wish first; so [let us know] something occurring with the enterprise [that will] change your income or projections. You wish to have a relationship along with your traders as a way to name them, speak by way of it, and work on it collectively. [Look] for traders who’ve some kind of expertise in your business. Have they got expertise themselves as operators? Have they invested in different corporations? Additionally, have the traders who’ve invested of their funds had expertise in your business?