by Jeffrey McKinney

October 18, 2025

Contract and fee delays are among the many largest setbacks hitting Black and different minority companies amid the federal authorities shutdown.

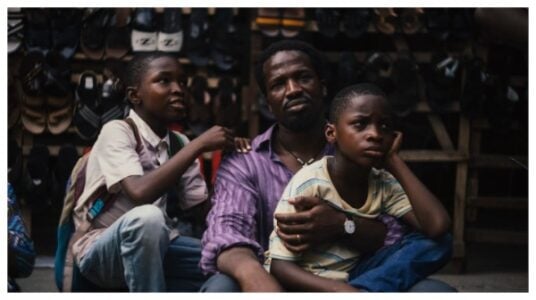

Black- and different minority-owned companies are being slammed by the federal authorities shutdown, severely hindering their working skill.

Began on Oct. 1, the closure is on tempo to be one of many longest in U.S. historical past. A brand new survey of these corporations by the Nationwide Minority Provider Improvement Council (NMSDC) exhibits they’re being negatively impacted by financial weak spot stemming from the shutdown.

Concurrently, the stoppage is projected to carry losses of between $400 million and $450 million for minority enterprise enterprises (MBEs), regardless of when the federal government reopens, primarily based on a brand new calculation by Inventive Funding Analysis.

That total estimate consists of $150 million in contract and fee delays, $125 million in diminished demand for enterprise items and providers, $75 million in staffing reductions together with layoffs, and $50 million from elevated short-term borrowing prices for the enterprises.

One of many nation’s largest enterprise advocacy teams for MBEs, the NMSDC received 89 responses from its member corporations from 26 states and jurisdictions that it quizzed over two days this month.

Don Cravins, interim president and CEO of NMSDC, said by e mail, “The numbers inform a painful reality. Inside our community of 15,000 minority-owned companies, greater than a 3rd are being straight hit by this shutdown.”

He said additional, “In simply three weeks, these corporations have misplaced almost 1 / 4 of their income–translating into tons of of thousands and thousands in financial losses. Behind each information level are actual entrepreneurs, actual workers, and actual households. We will’t afford to deal with minority-owned or small companies as afterthoughts–they’re important to America’s power and restoration.”

The newest survey comes as observers have surmised the shutdown may lengthen into November as legislators negotiate to finish the stalemate.

Usually, federal authorities shutdowns are dangerous information for small companies (SMBs). And people corporations with current contracts from federal businesses are reportedly among the many hardest hit throughout a shutdown.

Kelly Loeffler, administrator of the U.S. Small Enterprise Administration, an important lender to SMBs, said the federal company has halted guaranteeing loans as the federal government shutdown continues. It has been estimated that 320 small companies are ceasing to acquire $170 million in SBA-guaranteed funding every day amidst the shutdown.

William Michael Cunningham, an economist and proprietor of Inventive Funding Analysis, shared with BLACK ENTERPRISE says that he believes that the survey response price was comparatively small due to the apprehension many minority enterprise house owners really feel about taking a stand on any challenge now.

Furthermore, he declared the losses are everlasting and important. He says the survey he helped NMSDC compile confirmed almost 33% of respondents experiencing contract delays, virtually 34% fee interruptions, and 37% a gradual lower in providers. Operationally, virtually 32% reported delayed tasks or deliveries, and about the identical quantity have needed to alter money movement or fee schedules.

The NMSDC survey included MBEs confidentially reporting the whole lot from having “about $1.6 million in excellent accounts receivable tied to authorities contracts” to having “to take out enterprise money advance loans to make payroll.”

On adjusting, one said, “We’ve shifted our focus onto State alternatives that are in fiscal spending home windows with funding already authorized.” One other expressed, “Looking for extra personal alternatives or utilizing lending funds to buy purchasers from rivals who might scale back providers.”

Cunningham says whereas not each Black or minority agency depends on federal authorities contracts for income technology, many do.

Cravins concluded, “The findings give us a transparent course. “Our members aren’t asking for charity—they’re asking for stronger connections. We shall be increasing our work to facilitate intra-MBE partnerships, financing, and new digital platforms that make that collaboration simpler.”

RELATED CONTENT: Whoopi Goldberg Urges Congress To Forgo Pay Till Authorities Shutdown Ends