By Stacy M. BrownNNPA Newswire Senior Nationwide Correspondent@StacyBrownMedia

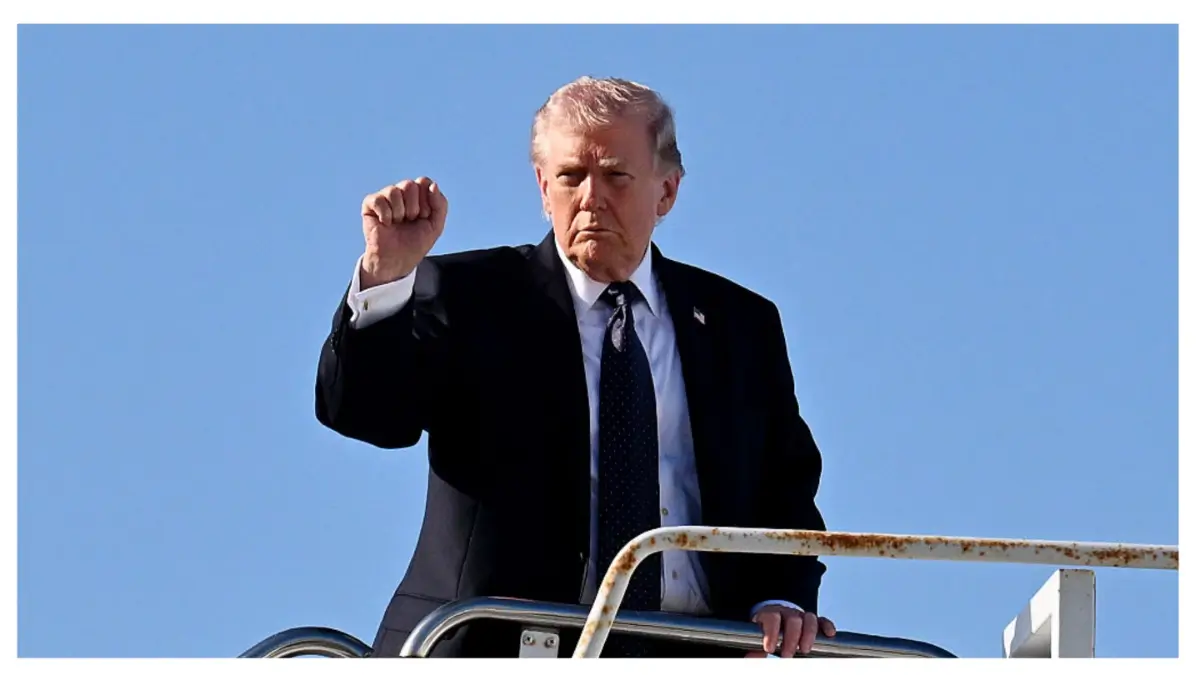

President Biden continues to make vital strides in assuaging the scholar mortgage debt disaster, saying the approval of debt cancellation for a further 74,000 scholar mortgage debtors. The newest motion contributes to the record-breaking aid the administration has offered to greater than 3.7 million People.

Earlier this month, Biden introduced the accelerated implementation of a vital provision below the Pupil Assist for Voluntary Schooling (SAVE) plan, which the administration stated has helped 3.6 million People by canceling their scholar debt. Biden stated the plan goals to create a extra reasonably priced scholar mortgage reimbursement construction whereas offering life-changing help to college students and their households.

“Immediately, my administration accredited debt cancellation for an additional 74,000 scholar mortgage debtors throughout the nation, bringing the entire quantity of people that have had their debt canceled below my administration to over 3.7 million People by means of numerous actions,” Biden stated in a press release on Jan. 19.

The beneficiaries of the most recent spherical of aid embrace practically 44,000 lecturers, nurses, firefighters and different public service professionals who’ve earned forgiveness after a decade of devoted service. Moreover, near 30,000 people who’ve been in reimbursement for a minimum of 20 years with out receiving aid by means of income-driven reimbursement plans will now see their money owed forgiven.

Biden credited the success of those aid efforts to the corrective measures taken to handle damaged scholar mortgage packages. He asserted that these fixes have eliminated limitations stopping debtors from accessing the aid they had been entitled to below the regulation.

The president outlined the broader achievements of his administration in supporting college students and debtors, together with reaching essentially the most vital will increase in Pell Grants in over a decade, geared toward aiding households with incomes under roughly $60,000 per 12 months. Different accomplishments embrace fixing the Public Service Mortgage Forgiveness program and introducing essentially the most beneficiant income-driven reimbursement plan in historical past, often called the SAVE plan, he stated. Debtors are inspired to use for this plan at studentaid.gov.

In response to challenges, together with the Supreme Court docket’s determination on the scholar debt aid plan, Biden affirmed the administration’s dedication to discovering different paths to ship aid to as many debtors as potential, as shortly as potential.

“From Day Certainly one of my administration, I vowed to enhance the scholar mortgage system in order that increased training offers People with alternative and prosperity, not the unmanageable burdens of scholar mortgage debt,” Biden asserted. “I received’t again down from utilizing each instrument at our disposal to get scholar mortgage debtors the aid they should attain their desires.”