Nationwide — Gloria Gaynor, a 91-year-old African American grandmother from Higher Darby, Pennsylvania, is going through doable eviction after her longtime house was bought over an unpaid property tax invoice. The brand new homeowners have warned they might contain police if she doesn’t go away the home.

Gaynor has lived in her house for about 25 years. Her household mentioned they have been shocked to be taught final month that the property had been bought and that eviction may quickly observe.

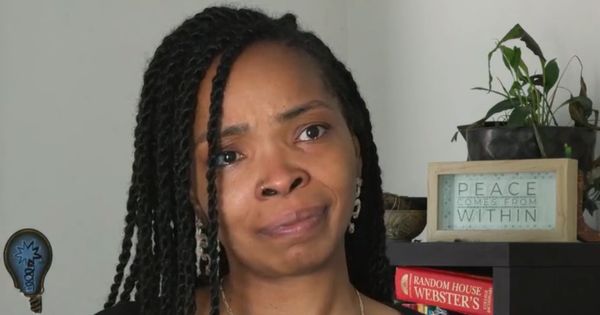

“She’s in a hospital mattress. Are they going to raise the mattress up along with her in it and take her and put her on the steps?” her daughter, Jackie Davis, instructed ABC Motion Information.

The problem traces again to 2020 through the COVID-19 pandemic. Gaynor stayed inside her house to keep away from the virus and missed paying her property taxes that yr. Her attorneys mentioned she had the cash and resumed paying in 2021, however the missed cost from 2020 was by no means settled.

As a result of the steadiness remained unpaid, the county positioned a tax lien on the house. In September 2022, the $3,500 tax debt was bought at a tax sale for greater than $14,000 to CJD Authorized Group. Below Pennsylvania legislation, buying the tax debt additionally transfers possession of the property.

Gaynor’s authorized crew challenged the sale in court docket however misplaced. Court docket data present the house was appraised at about $250,000 earlier this yr.

Now, Davis is attempting to determine what comes subsequent. “I simply must provide you with a plan to have the ability to take her to a house with me. That’s my answer,” she mentioned. Davis added that her mom has dementia and would battle in an assisted residing facility.

Public data present CJD Authorized Group has bought dozens of tax-defaulted properties in Delaware County. The corporate didn’t reply to requests for remark. County officers mentioned eviction can solely transfer ahead with court docket approval and confirmed that no writ has been filed to this point.