by Derek Main

December 29, 2023

Black Enterprise has 10 suggestions that will help you attain your monetary targets in 2024, whether or not it is for retirement, saving for school, or beginning a enterprise.

Initially Printed Dec. 26, 2022

2024 is simply over the horizon as we shut out December, and it’s setting as much as be one other 12 months of instability, even with inflation cooling and lingering fears that the nation is heading right into a recession.

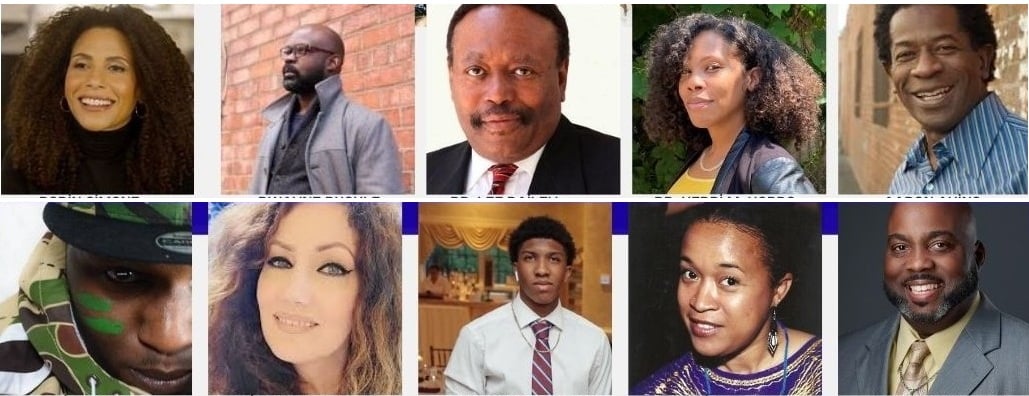

For those who’re a budding entrepreneur, an investor, or somebody trying to construct wealth, doing it proper will take analysis, a hustle mentality, and the fitting info. BLACK ENTERPRISE is right here that will help you with 10 suggestions from high monetary consultants within the new 12 months.

Decide your monetary targets

Everybody has completely different targets. Whether or not it’s restoring credit score, saving for retirement, shopping for a house, or paying school tuition, realizing what you wish to do within the new 12 months is step one.

Figuring out your brief and long-term monetary targets is step one towards reaching them and also will hold you from setting your targets too excessive.

“One of many difficulties with goal-setting is ‘all or nothing pondering,” Brittney Castro, a licensed monetary planner, instructed NBC. “It’s an excessive mindset, and once we do issues like that, we set ourselves up for failure as a result of we don’t consider all of the grays of life.”

Funds

The second step in any monetary plan is budgeting. It doesn’t matter what your targets are, saving, restoring your credit score, or wealth constructing; you possibly can’t get on the street to monetary freedom with out a map, and your finances is that map.

“My finest tip for monitoring, organizing, and staying on high of my funds is to create a month-to-month finances or a spending plan (for many who discover the phrase finances actually boring). The significance of making a finances can’t be over-emphasized as a result of having a finances helps me,” Esther Mukoro, a monetary coach and the founding father of Cash Nuggets, instructed Liberty Paperwork Options.

For those who can’t stick with your finances, plan your spending

For those who’ve set finances after finances and repeatedly blow by them, then it could be simpler to create a spending plan as a substitute.

“The idea of residing on a spending plan as a substitute of a finances can provide you freedom and peace of thoughts,” Loreen Gilbert, a wealth supervisor, instructed Bankrate.

Moreover, a spending plan means that you can select what to spend your cash on as a substitute of being centered on what you possibly can’t purchase. Begin with obligatory bills, lease, meals, utilities, and financial savings. Cash administration apps may also enable you to hold observe of issues and make automated funds or transfers.

Observe your accounts and your purchases usually

In some months, individuals will be frugal, whereas in different months, individuals may overspend a bit if points or occasions come up. Monitoring your accounts usually is not going to solely present you the place your cash goes but in addition when your spending is getting out of hand. It might probably additionally assist let you understand when it’s time to drag again on spending and save extra.

“Verify your account balances every day and see the place your cash is de facto going. This will additionally enable you to see when your funds are getting too low, and it’s essential curb your spending. I additionally suggest that individuals observe each buy for 30 days and likewise write down how they felt after the acquisition. Many instances, we spend mindlessly and never essentially inside our values. This train will be eye-opening,” Melanie Lockert, writer and founding father of the weblog Pricey Debt, instructed Liberty Options.

Plan month-to-month no-spend weekends

The most effective methods to economize is by not staying in. No-spend weekends are a good way to present your accounts and playing cards a break. Begin by planning in your weekends forward of time. Choose up no matter meals and leisure you want earlier than the weekend. For those who stay in a big metro space, work out what free occasions there are that weekend that’ll pique your curiosity. Another choice is to remain at residence with some consolation meals, keep out of the winter climate, and stream your favourite films and reveals.

“I did my first no-spend week just a few months in the past and saved over $200,” Emma Newberry stated in an article she wrote for The Motley Idiot.

MoneyGeek additionally incorporates a record of greater than 40 issues you are able to do on a weekend to fill a no-spend weekend.

Enhance your retirement financial savings

For these of you who’re already properly into your monetary plan and are ready for that stunning day known as retirement, boosting your retirement financial savings is paramount, as inflation is driving many who known as it quits again into the workforce.

At the moment, it’s essential guarantee your retirement cash will final and that unpredictable circumstances don’t empty your financial savings quicker than you deliberate. Lorna Sabbia, the top of retirement and private wealth options at Financial institution of America, suggests taking a long-term strategy to your retirement plans.

“Use [the new year] to spice up or maximize contributions to 401(okay)s or HSAs, plot out holistic retirement targets (e.g., The place will I stay? Will I work? How a lot to finances for journey?) and, regardless of your age or life stage, take significant steps to spice up your monetary wellness,” Lorna Sabbia, the top of retirement and private wealth options at Financial institution of America instructed Bankrate.

For those who’re investing, watch for the fitting alternative

In 2023, finance consultants throughout the U.S. continued to say {that a} recession was coming, and whereas many are scared about that, Kara Stevens, The Frugal Feminista, instructed Black Enterprise Senior Vice President Alfred Edmond Jr. {that a} recession additionally brings alternative.

“Technically, a recession is when there isn’t any progress or adverse progress within the economic system, and usually you’ll see increased unemployment, increased rates of interest, and fewer client spending,” Stevens instructed Edmond on the Your Cash, Your Life podcast. “The bigger context is that these are cycles.”

“For these of us that perceive the cycles, this can be a nice time to make the most of gross sales available in the market, so in the event you change that mindset of shortage into considered one of alternative, realizing that recessions occur and after the bear market, there’s a giant bull market proper after so that you need to have the ability to get by the recession for no matter occurs after.”

Sticking to your monetary targets throughout a recession will provide you with entry to extra alternatives because the market and the economic system start to bounce again.

Discovering capital to start out or assist your corporation

For those who’re a budding entrepreneur on the lookout for funding, there at the moment are a wealth of locations the place you possibly can apply for funding. Lendistry, the one nationwide fintech CDFI and the one African American-led small enterprise lending firm is giving out $200 million to small and micro-businesses in New York. The Black Cooperative Funding Fund gives micro-loans to Southern California’s small companies.

“We take into account ourselves in all probability one of many largest African American deployers of capital within the US,” Everett Sands instructed BLACK ENTERPRISE. “And after George Floyd, what was essential to me because the CEO is that we obtained an opportunity to take a seat on the desk and assist to affect or add our voice when varied purchasers have been beginning to create applications such because the NY State Seed Fund.”

Moreover, Black celebrities, together with tennis legend Serena Williams, rapper Jay-Z, producer Pharell Williams, and others, are giving out loans to minority and female-led small companies.

Steer clear of dangerous investments

The tech business has been one of the crucial tried and true investments lately, with the expansion of Amazon, Apple, and Google. Cryptocurrency has additionally been considered as a quick technique to drive your accounts up.

Nevertheless, the tech business is shedding 1000’s of employees nationwide. On the identical time, many who poured cash into cryptocurrency have misplaced it in what’s an unregulated market, together with some notable celebrities and athletes who took cash in Bitcoin.

Investing in safer areas isn’t foolproof, however they’re areas the place funding and the world are rising. Inexperienced vitality is an space the place funding is exceeding predictions as a consequence of rising vitality prices worldwide. Moreover, a number of sectors in inexperienced vitality, together with photo voltaic, wind, hydroelectric, and geothermal, are rising worldwide, together with within the U.S.

Keep in mind, cash administration is a marathon, not a dash

Any type of cash administration, regardless of how huge or small, takes time. Rome wasn’t in-built a day, and your monetary targets received’t be achieved in a day, both. It would take months and perhaps even years of you saving, spending frugally, and sacrificing.

For those who really feel like budgeting and limiting your spending is just too arduous, bear in mind what the purpose is and the way far you’ve made it. Additionally, make it some extent to have fun small milestones on the best way to your purpose; it’ll hold you motivated to get to the end line.

Keep in mind, that is in your monetary future and freedom, so keep optimistic and hold your purpose in thoughts as a result of if you lastly hit that purpose, you’ll notice it wasn’t as arduous because it appeared on that first day.

RELATED CONTENT: 5 New 12 months Methods To Assist Black Companies Flourish In 2024